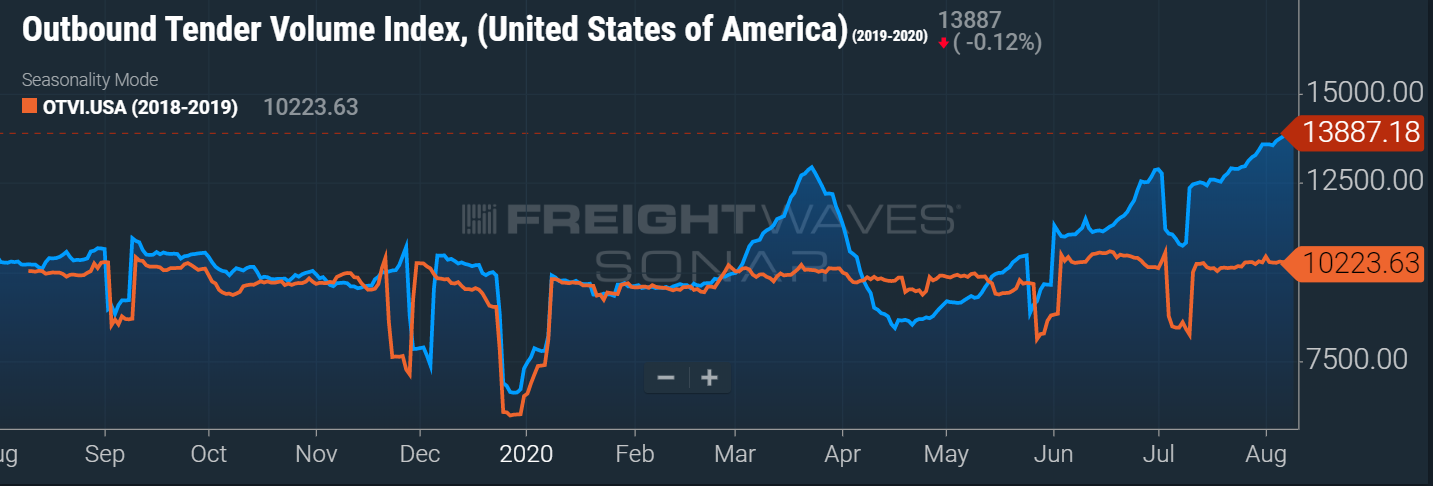

NATIONAL FREIGHT VOLUME: 31% Above 2018-2019

The freight market is still amid a shake-up. Tender rejections were higher last week in 87% of the 135 freight markets we monitor compared to last week as volumes maintained their strength, carriers rejected more freight, and spot rates found renewed momentum. Due to the data we have access to, we believe that trucking capacity may very well be at its maximum and this is what shippers will be facing through Q4. Via discussions with carrier partners and clients, rates are steadily climbing throughout the supply chain.

The freight market is still amid a shake-up. Tender rejections were higher last week in 87% of the 135 freight markets we monitor compared to last week as volumes maintained their strength, carriers rejected more freight, and spot rates found renewed momentum. Due to the data we have access to, we believe that trucking capacity may very well be at its maximum and this is what shippers will be facing through Q4. Via discussions with carrier partners and clients, rates are steadily climbing throughout the supply chain.

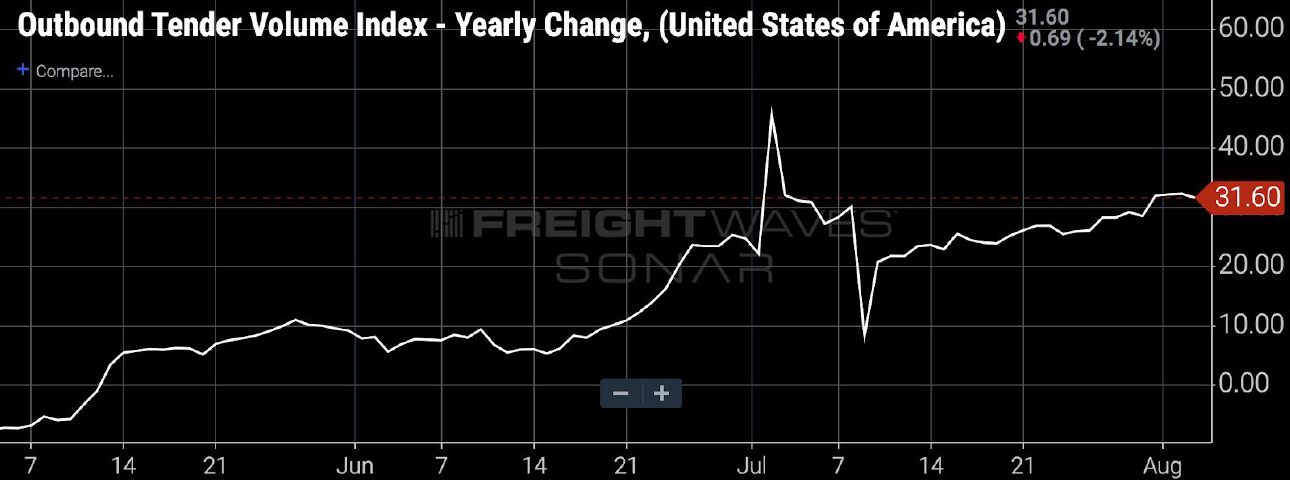

Tendered requests for truckload capacity are soaring. They are up 31.6% year-over-year and essentially at all-time highs on an absolute basis. The national Outbound Tender Volume Index (OTVI.USA) has jumped 61% since the April low and higher by 5% from the high on July 2.

Every length of haul across the mileage band tightened last week. The group is led by tweener (450-800 mile) rejections, which breached 28% for the first time in more than 18 months. Tweener rejections are followed closely by midhaul (250-450 miles) and long haul (800-plus miles) which are both well above 20%. Short haul (100-250 miles) rejections have steadily increased to above 16%, the highest level since late 2018.

The three main catalysts for growth in truckload tenders remain the same: fiscal stimulus, easy monetary conditions and a broad recovery in the global economy. The biggest risk to the domestic and global freight markets is still, of course, the coronavirus.

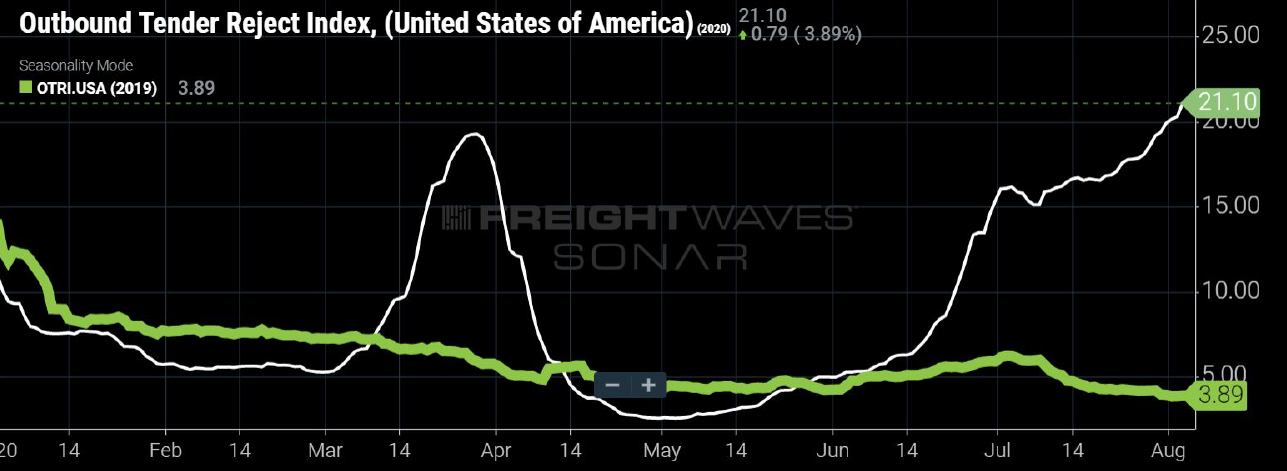

Tender Rejection Rates at 21%

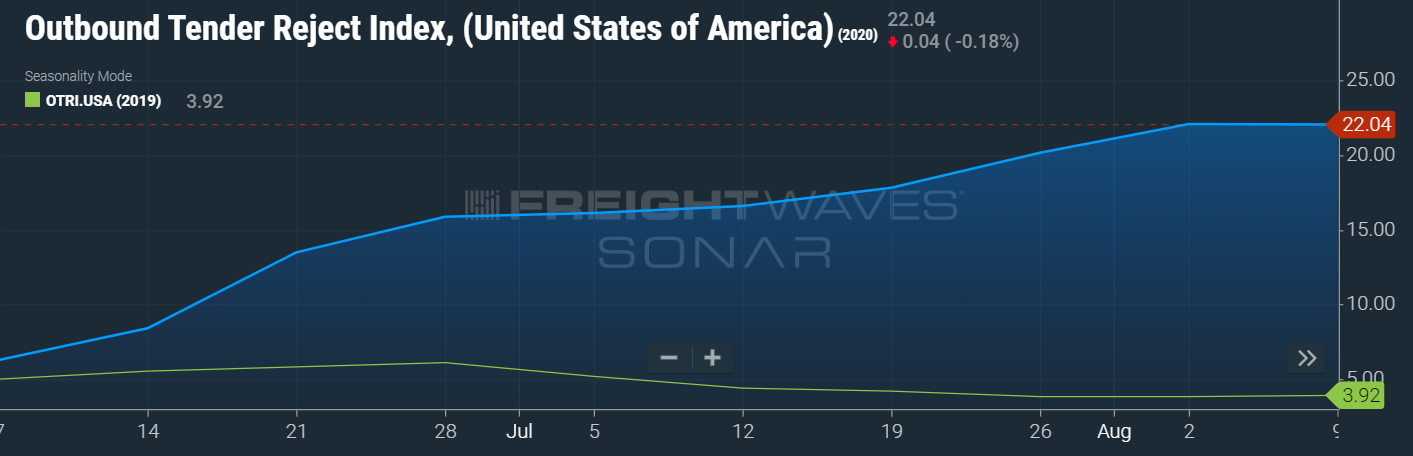

Truckload capacity continues to tighten, and spot rates continue to rise, driven by strength in truckload volumes, widespread network dislocation, and fundamentally tighter capacity. Due to the freight market strength that persisted through July, diverging from historical patterns, we believe that the current rate environment is being driven by a broader and more profound cyclical shift, not seasonality. Truckload carriers are already benefiting from the market shift and are rejecting 21% of tendered loads from large shippers (OTRI.USA).

Truckload capacity continues to tighten, and spot rates continue to rise, driven by strength in truckload volumes, widespread network dislocation, and fundamentally tighter capacity. Due to the freight market strength that persisted through July, diverging from historical patterns, we believe that the current rate environment is being driven by a broader and more profound cyclical shift, not seasonality. Truckload carriers are already benefiting from the market shift and are rejecting 21% of tendered loads from large shippers (OTRI.USA).

The increase over the past week brought rejection levels to the highest point since June 2018 and nearly 200 bps* higher than the “panic-buying” surge in late March. Truckload capacity has broken well out of seasonal trends as capacity tightened the entire month of July, typically a soft month for freight. OTRI currently sits 1,721 basis points above year-ago levels and 288 bps above 2018 levels.

The increase over the past week brought rejection levels to the highest point since June 2018 and nearly 200 bps* higher than the “panic-buying” surge in late March. Truckload capacity has broken well out of seasonal trends as capacity tightened the entire month of July, typically a soft month for freight. OTRI currently sits 1,721 basis points above year-ago levels and 288 bps above 2018 levels.

It’s vital to remember that truckload volumes are not being driven higher by economic out-performance, but by a shift in consumer behavior. We think that these freight-based consumer behaviors, which include a lack of travel opportunities, higher demand for grocery, and intensified e-commerce buying, may not be permanent, but they will last longer than some expect and they will be resilient in the face of renewed shutdowns or COVID outbreaks.

At MegaCorp, we continue to have strong relationships with our vetted carrier partners which allows us to offer competitive rates with exceptional service to our valued clients. The market remains extremely tight right now due to the high demand for trucks. The market will shift again but most likely not until early 2021.

* Basis points, otherwise known as “bps” or “bips,” are a unit of measure used in finance to describe the percentage change in the value or rate of a financial instrument. One basis point is equivalent to 0.01% (1/100th of a percent) or 0.0001 in decimal form. The above information within the article is quoted and paraphrased from Freightwaves.

Load to truck ratio on 8/10/20 for the prior week:

MegaCorp Logistics, founded by Denise and Ryan Legg in 2009, specializes in full truckload shipments (dry van, refrigerated, flatbed, intermodal, etc.) and less-than-truckload shipments throughout the US, Canada, and Mexico. MegaCorp is committed to creating long-term, strategic partnerships with our clients who range from Fortune 100 companies to regional manufacturers and distributors. We serve all business sectors of the US economy including (but not limited to) food, retail, government, textiles, and metals/building materials. We strive to offer the best to our clients, transportation partners and employees– It’s the Mega Way!

For a shipping quote, please CLICK HERE.