Temporary Plateau

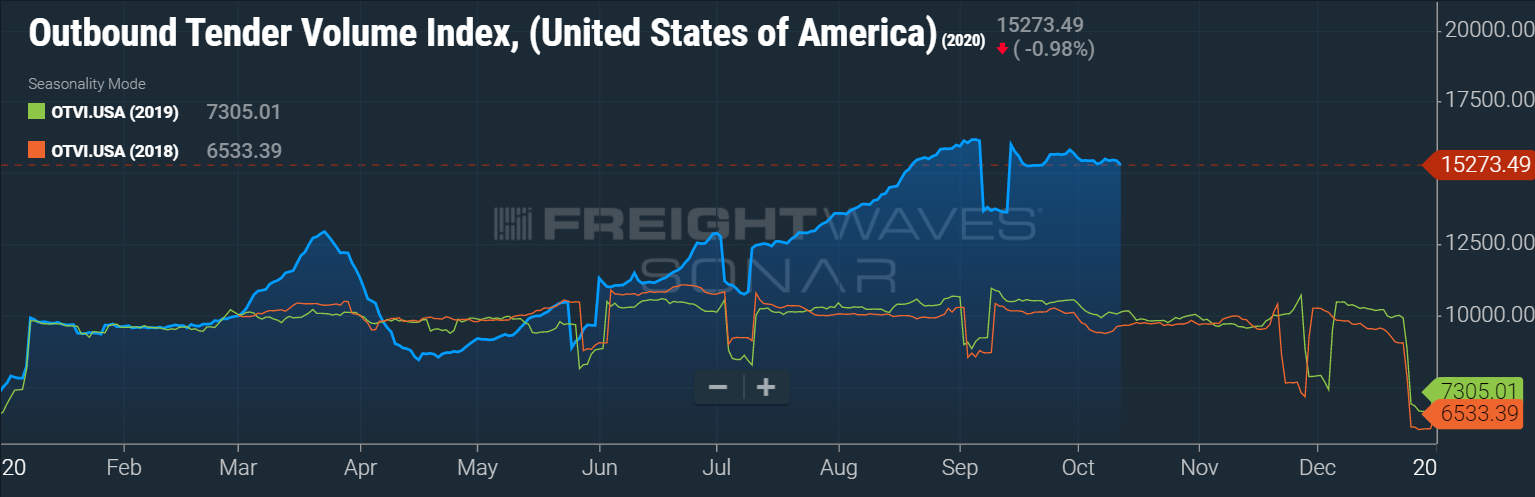

There is no change from last week with freight volumes holding steady overall with 45%-50% more freight tendered weekly, compared to this time last year. Is this where the freight market will stay? Unfortunately, it will probably get a bit worse before any sustainable relief occurs. As shown within the top chart (according to 2018 in orange and 2019 in green) freight volumes should be consistent for the next month, with a spike right before Thanksgiving, during a typical holiday season. However, 2020 is clearly not a “normal” year. Significantly more online shopping is expected to take place this Holiday season which should cause the Tender Volume Index to start climbing again.

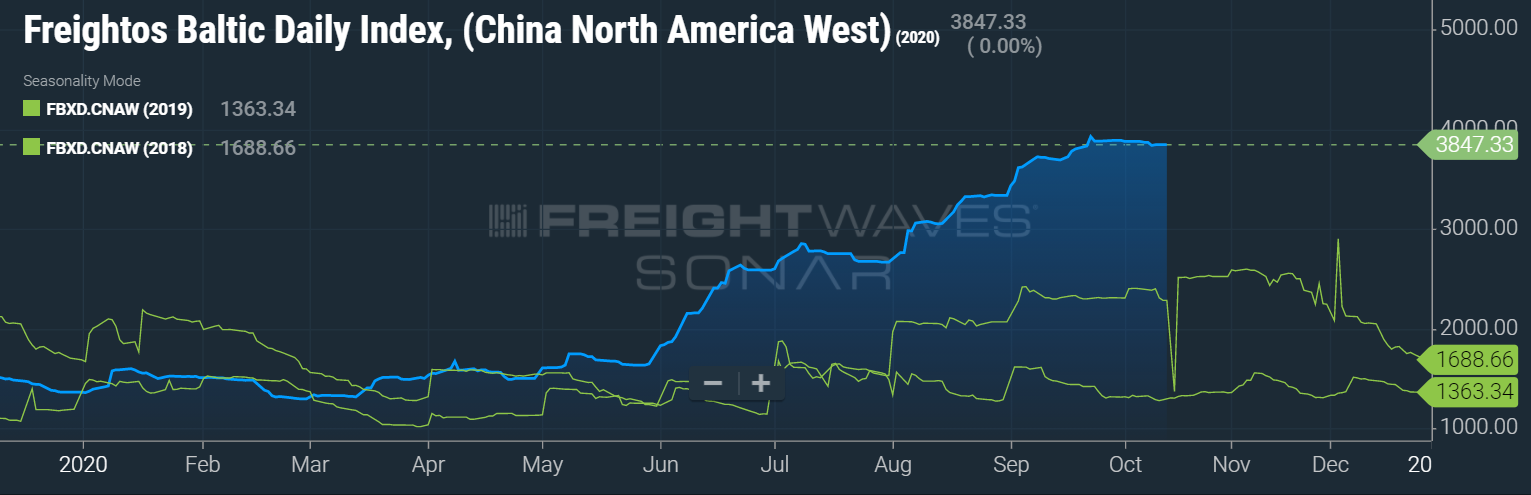

There are also many more shipments coming from overseas that will add to the tender volume index within the upcoming weeks. This chart shows what is on its way from China to just the Pacific Northwest port, which should continue to rise through mid-November.

There are also many more shipments coming from overseas that will add to the tender volume index within the upcoming weeks. This chart shows what is on its way from China to just the Pacific Northwest port, which should continue to rise through mid-November.

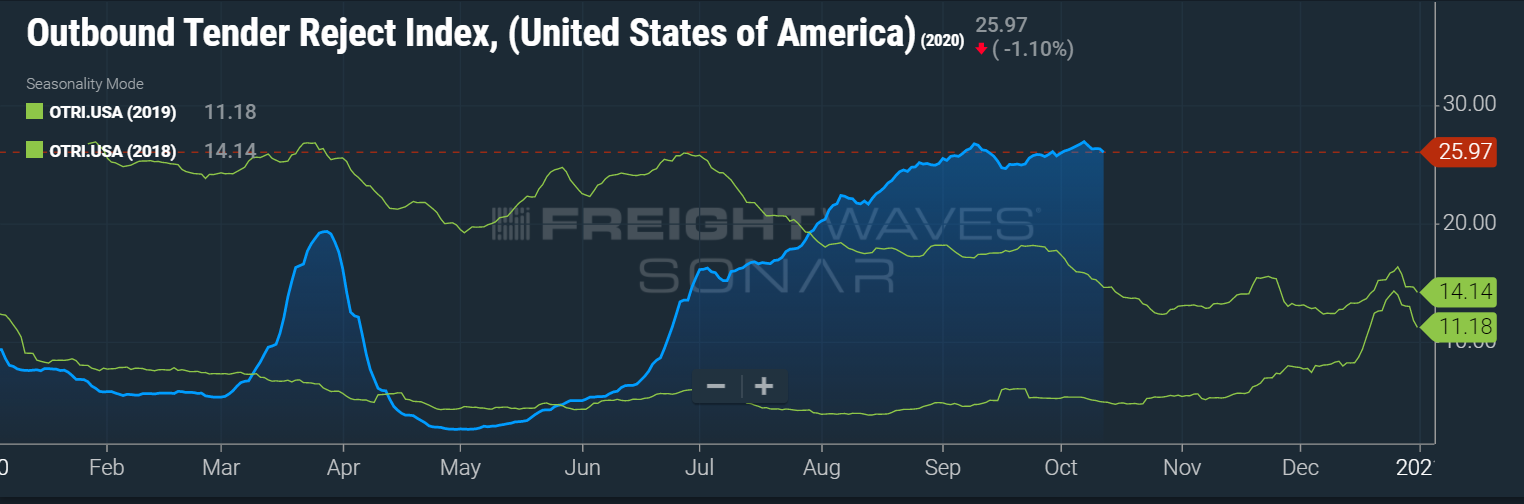

The increased volume is one of the factors that has continued to keep the tender rejection rates extremely elevated, as shown in the chart below. The top green line in the chart is 2018 and the bottom green line is 2019. Currently, the tender rejection rate is at 25.97%, a slight decrease from last week, but 1 in 4 loads being turned down by carriers is the new normal. This is a whopping 400% increase in the Tender Rejection Index year-over-year.

As we discussed last week, the new “standard” of rejection rates is strong enough to keep spot rates high. This also has an impact on the upswing in tender rejections, even when there is a slight dip in overall freight volumes. Spot rates are more than contracted rates, making it easy for carriers to turn down contract rate loads to pick up the higher-priced spot loads, keeping rates elevated.

As we discussed last week, the new “standard” of rejection rates is strong enough to keep spot rates high. This also has an impact on the upswing in tender rejections, even when there is a slight dip in overall freight volumes. Spot rates are more than contracted rates, making it easy for carriers to turn down contract rate loads to pick up the higher-priced spot loads, keeping rates elevated.

At MegaCorp, we have strong relationships with our reliable, vetted carrier partners so when we commit to picking up a load, we will see it through and will not give the freight back or leave the load on the dock. Customer service and the reputation of our clients are important to us, so we make it a priority to pick up and deliver every load entrusted to MegaCorp, even when rejection rates are over 25%.

To conclude this week’s update on a positive note, according to the CCJ, new truck orders last month soared 23,500 units over August and were 33,400 higher than September 2019. Trailer orders for the last 12 months total 224,100 units. Strong order totals from the last two months should push trailer production back to pre-pandemic levels to close out the year, with more increases expected starting early next year. This will help some of the strain on capacity, which will be most noticeable in Q2 of 2021.

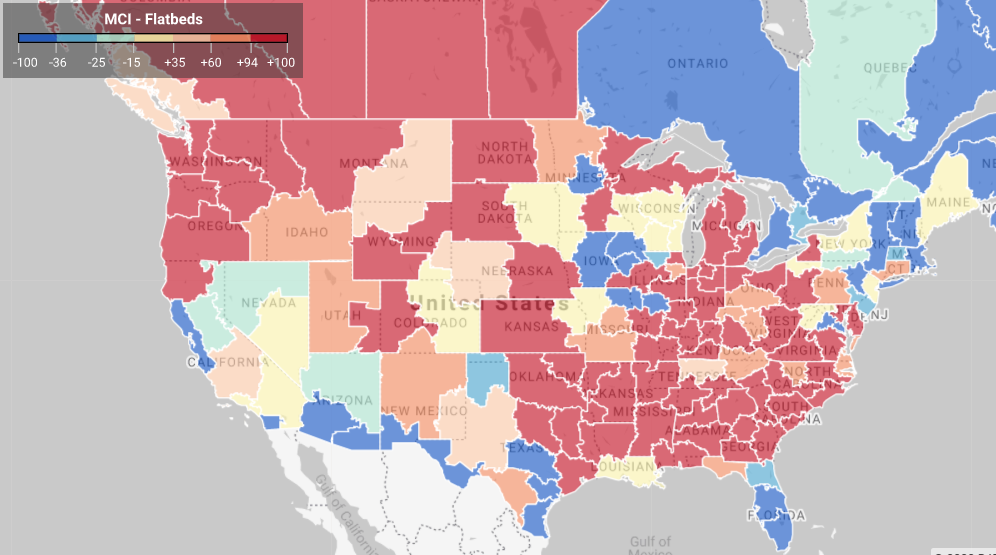

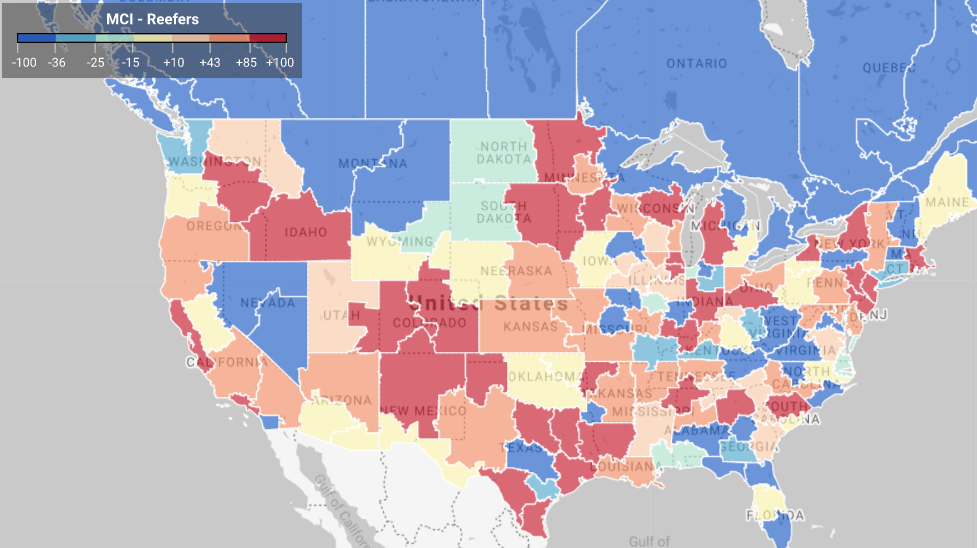

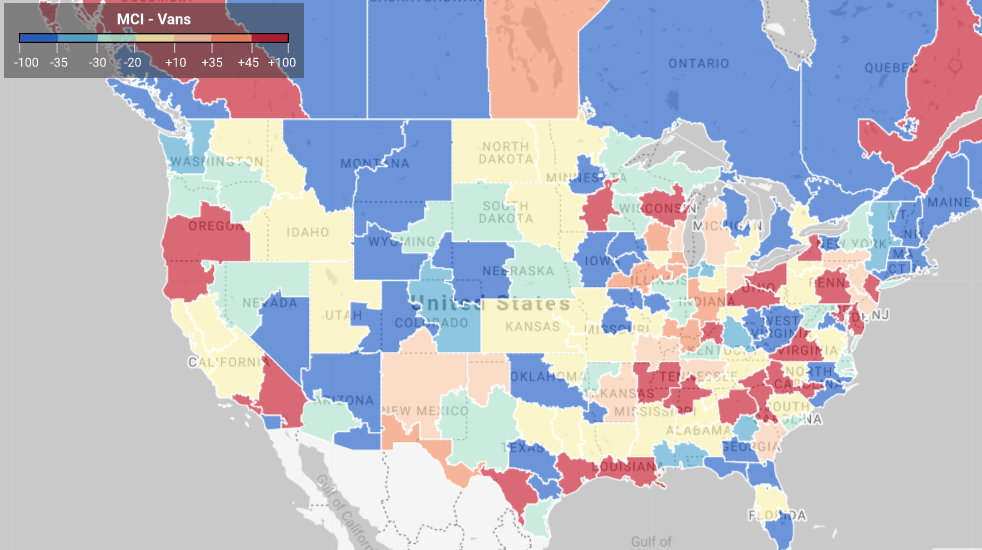

Load to truck ratio from the prior 7-day average.

About MegaCorp

MegaCorp Logistics, founded by Denise and Ryan Legg in 2009, specializes in full truckload shipments (dry van, refrigerated, flatbed, intermodal, etc.) and less-than-truckload shipments throughout the US, Canada, and Mexico. MegaCorp is committed to creating long-term, strategic partnerships with our clients who range from Fortune 100 companies to regional manufacturers and distributors. We serve all business sectors of the US economy including (but not limited to) food, retail, government, textiles, and metals/building materials. We strive to offer the best to our clients, transportation partners, and employees– It’s the Mega Way!

For a shipping quote, please CLICK HERE.