Current Market and March Projections

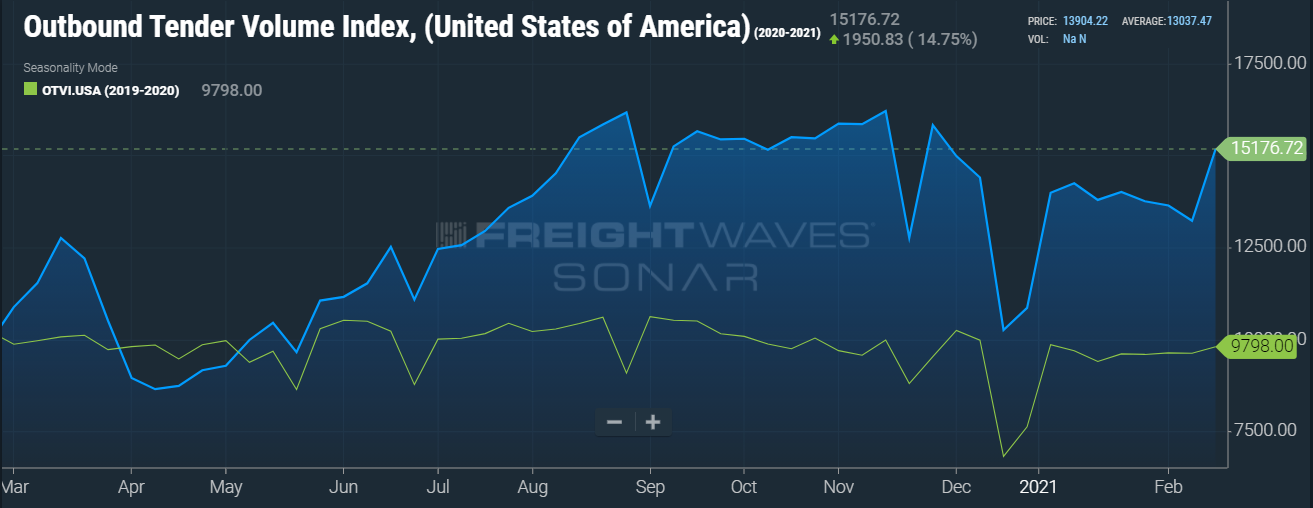

Freight volumes decreased for the first part of February but have drastically climbed over the past week as the industry plays catch up due to the widespread winter storms last week. Freight volumes are now 55% higher than this time last year. Even at the lowest volume point in February, volumes were still 40% up when compared to the same time frame in 2020.

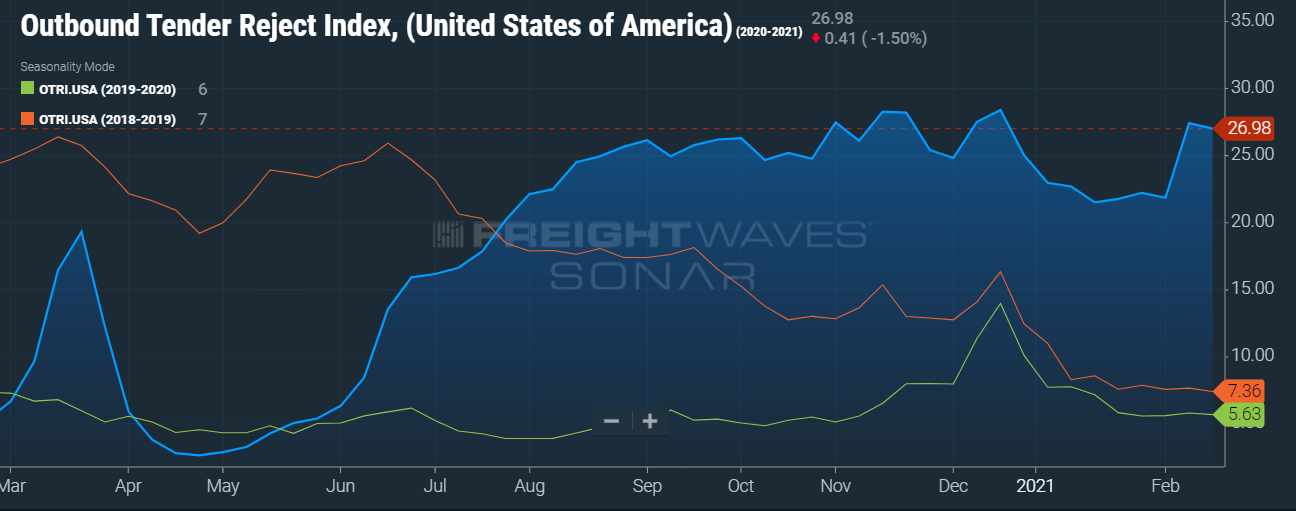

Also stemming from the hazardous weather, tender rejections rose to 27%, which climbed from 21% the prior week and is more than five times higher than 2020.

The severe weather, coupled with very strong volumes, was enough to increase the already, extremely high spot rates by another 4% in one week, which is 42% greater than this time last year. Also contributing to higher rates is the continuous rise in diesel prices which is currently 77% higher than in November. This will continue until the existing, strained capacity evens back out to the “new normal” which will take some time. The volatile market doesn’t end now that the storm is over.

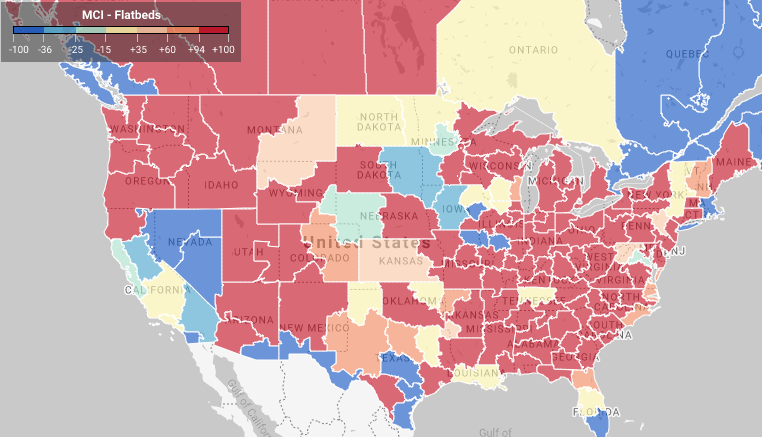

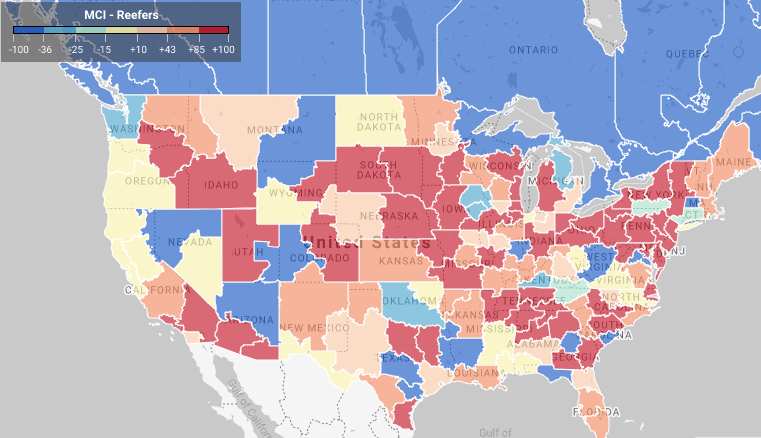

Since Dallas is a major market, this impacted capacity nationwide. Carriers avoided that area and shippers had to temporarily shut down. Shippers that could, turned to shipping goods out of other major distribution centers as noted by the Los Angeles market (blue) and Chicago market (red) as an example. The chart shows a 15% increase when the weather got bad in TX as tenders drastically increased there as the state shut down. Carriers in TX could charge a premium and shippers in markets like LA and Chicago had to accommodate an unexpected jump in volume, while other parts of the country were scrambling for capacity.

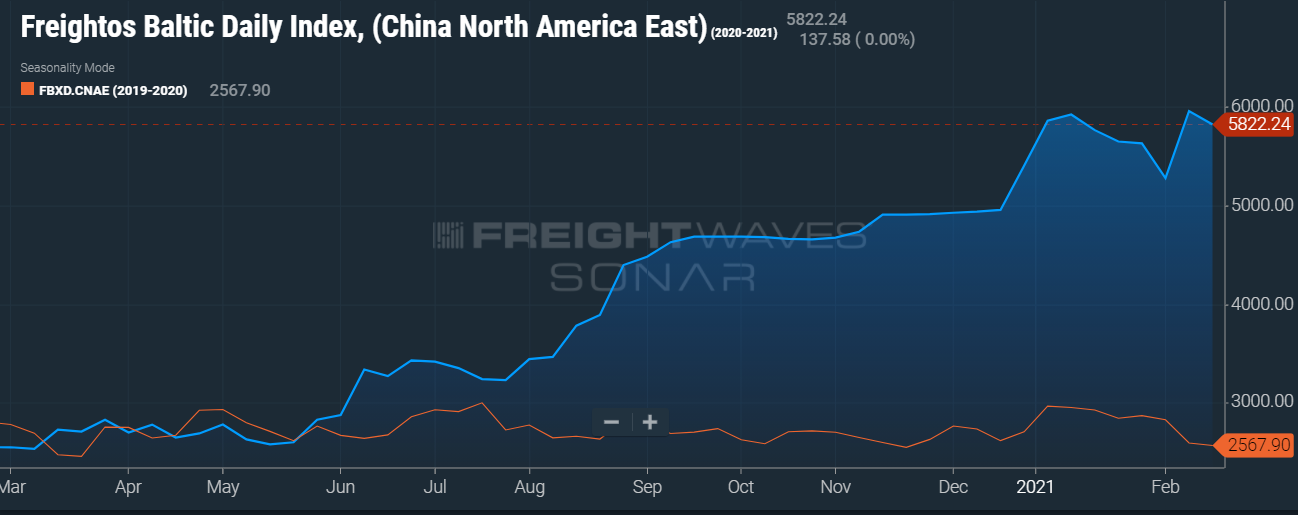

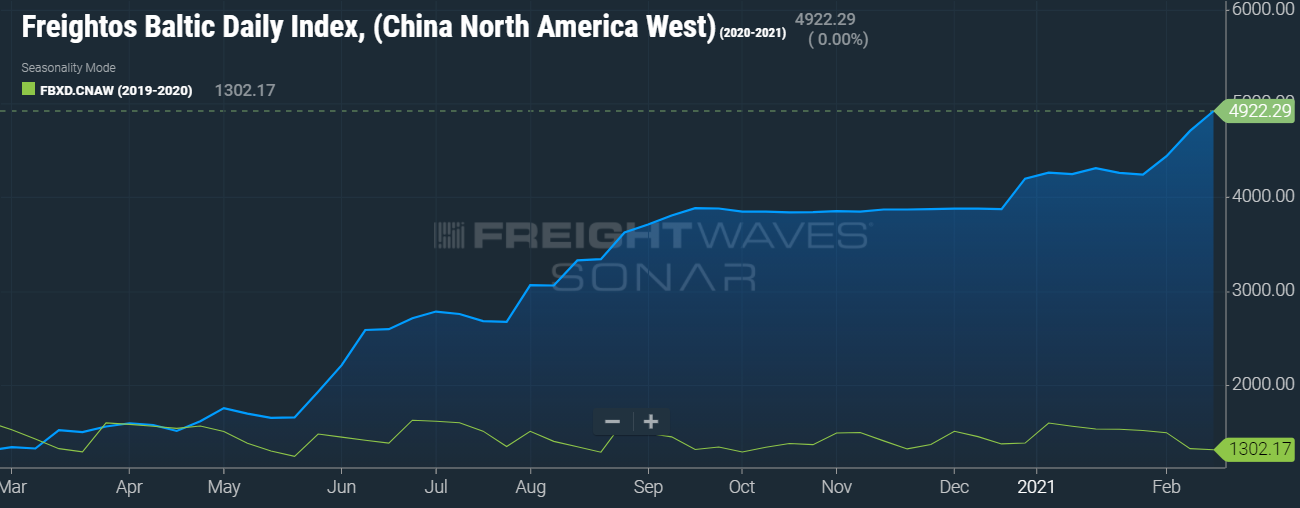

Record volumes at the ports signify that freight volumes are going to remain elevated as the ports work through congestion and backlog as shown in the two charts below. Due to this congestion, production has been impacted at truck equipment manufacturers. This results in further delays in delivering the equipment needed to help ease some of the capacity constraints.

Additionally, as restrictions due to Covid continue to lift, more employees will be able to return to manufacturing plants without social distancing rules in effect. This will allow companies to catch up on orders which will add more truckloads back into the market. Over time as we ease back into an era of no restrictions, consumer spend will shift back slightly, and eventually, the capacity crunch won’t be as extreme. As a result, rates won’t be as high. That being said, this shift will not happen in March, or especially with the beginning of produce season.

Through all the volatility, MegaCorp is here to provide reliable service and fair pricing in any market. You can trust that we will deliver.

Load to truck ratio from the prior 7-day average:

About MegaCorp

MegaCorp Logistics, founded by Denise and Ryan Legg in 2009, specializes in full truckload shipments (dry van, refrigerated, flatbed, intermodal, etc.) and less-than-truckload shipments throughout the US, Canada, and Mexico. MegaCorp is committed to creating long-term, strategic partnerships with our clients who range from Fortune 100 companies to regional manufacturers and distributors. We serve all business sectors of the US economy including (but not limited to) food, retail, government, textiles, and metals/building materials. We strive to offer the best to our clients, transportation partners, and employees– It’s the Mega Way!

For a shipping quote, please CLICK HERE.