Current Market and February Projections

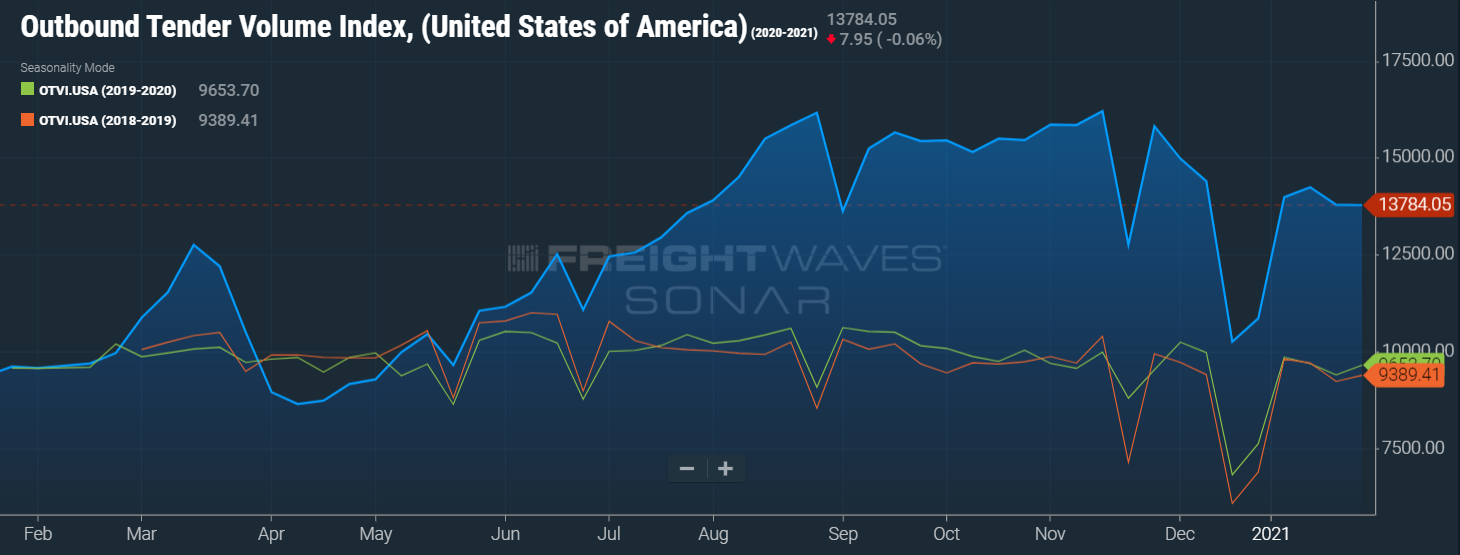

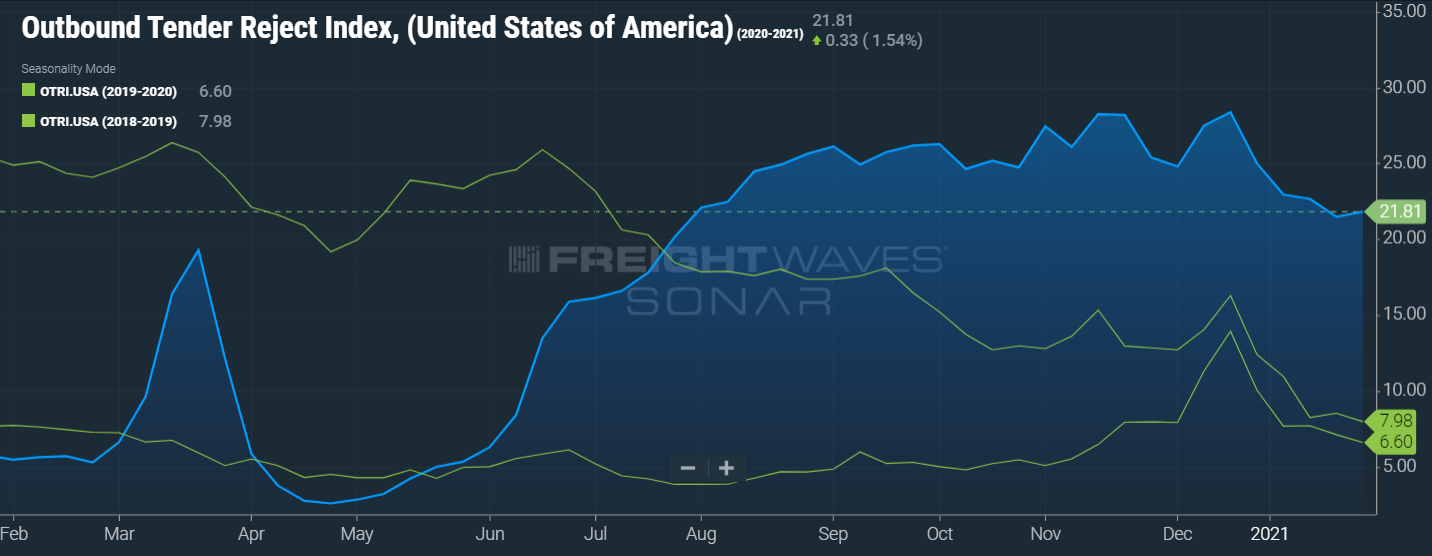

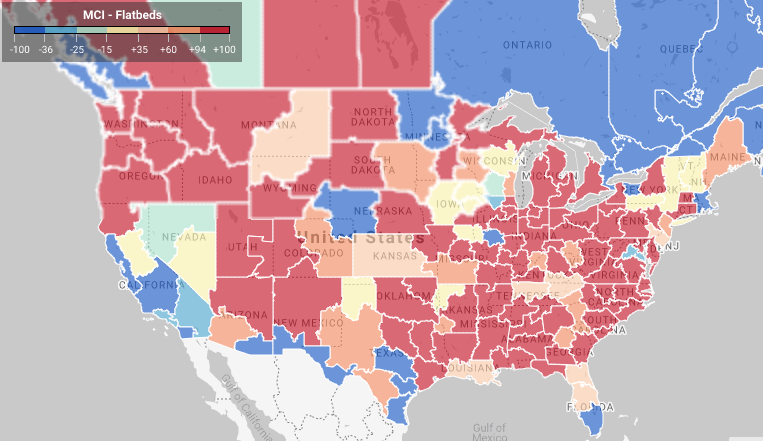

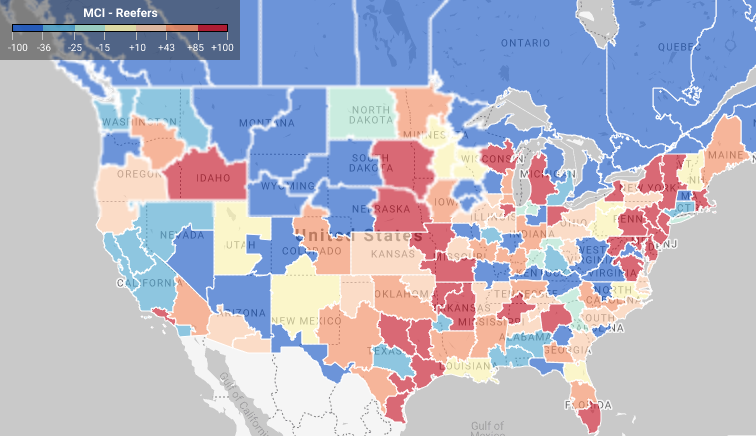

2020 brought the highest shipping volumes, tender rejections, and rates that the industry has ever seen. These records were not just barely broken, they were shattered. During the second half of 2020, there was well over 50% more freight on the road than there was in 2019. The influx in shipments stemmed from the shift in consumer spending. People changed their spending habits from service-based to goods-based because of the stay-at-home orders. This led to increased spend on home projects and groceries. E-commerce shipments increased by over 25% in 2020, reflecting the aforementioned spending habits. The abundance of new truckloads led to a nationwide capacity shortage with too many loads and not enough trucks. This has caused the tender rejection rate to stay over 20% since late July. These factors made spot rates higher priced than contract rates, which further added to the volatile market and monthly rate increases.

Now that 2021 is here, we are looking at trends to determine what the transportation market is going to do. This will take time due to uncertainties and unintended consequences from the COVID pandemic. Freight volumes sit at 43% higher year-over-year. Tender rejections are at 21.4% currently, whereas rejections were at 7% in January of 2020.

Rates

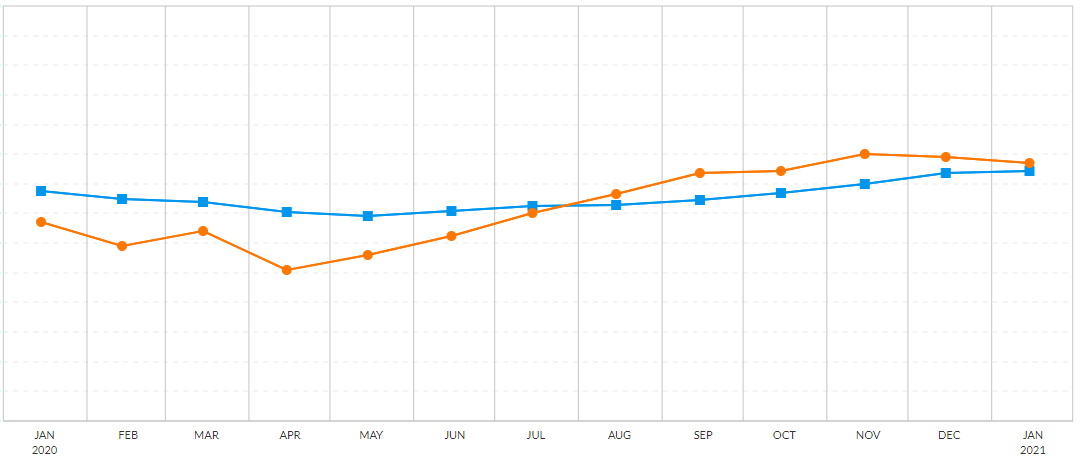

The good news is that there has been a slight decrease in spot rates for some markets as contract rates climb, and as overall volumes and rejections decrease. With contract rates up 18% year-over-year on average, the national difference between spot and contract rates is the narrowest it’s been since spot rates outpriced contract rates back in August of 2020 (reefer spot rates are in orange and contract rates are in blue in the chart to right). This is great news for shippers because as contract lanes get priced higher than spot rates, fewer loads will hit the spot market.

The good news is that there has been a slight decrease in spot rates for some markets as contract rates climb, and as overall volumes and rejections decrease. With contract rates up 18% year-over-year on average, the national difference between spot and contract rates is the narrowest it’s been since spot rates outpriced contract rates back in August of 2020 (reefer spot rates are in orange and contract rates are in blue in the chart to right). This is great news for shippers because as contract lanes get priced higher than spot rates, fewer loads will hit the spot market.

However, don’t celebrate the softness in the rate market yet. This is a temporary relief due to issues continuing to plague the industry. Even with fewer loads hitting the spot market, this doesn’t fix the serious supply and demand issue with the truck and driver shortage happening across the nation. The closure of driver schools to award new CDLs contributed to the reduction of new drivers entering the transportation workforce. On the other side of the spectrum, many aging drivers chose to retire early rather than risk contracting COVID, further reducing available drivers and contributing to the driver shortage. This supply and demand issue and change in consumer spend are the driving factors as to why rates won’t quickly decrease in Q1 or as soon as all restrictions are lifted.

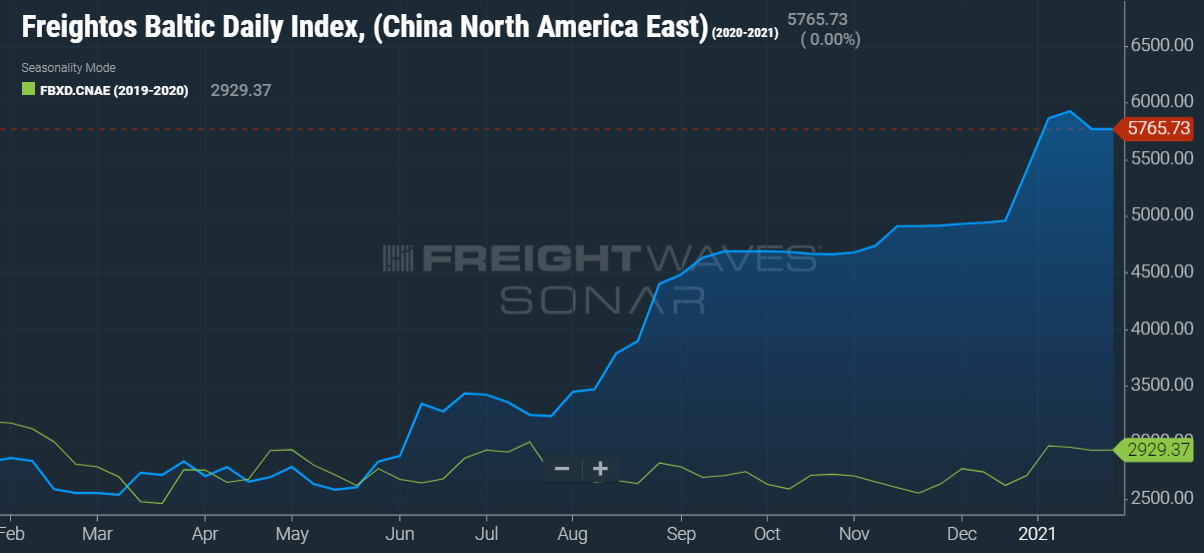

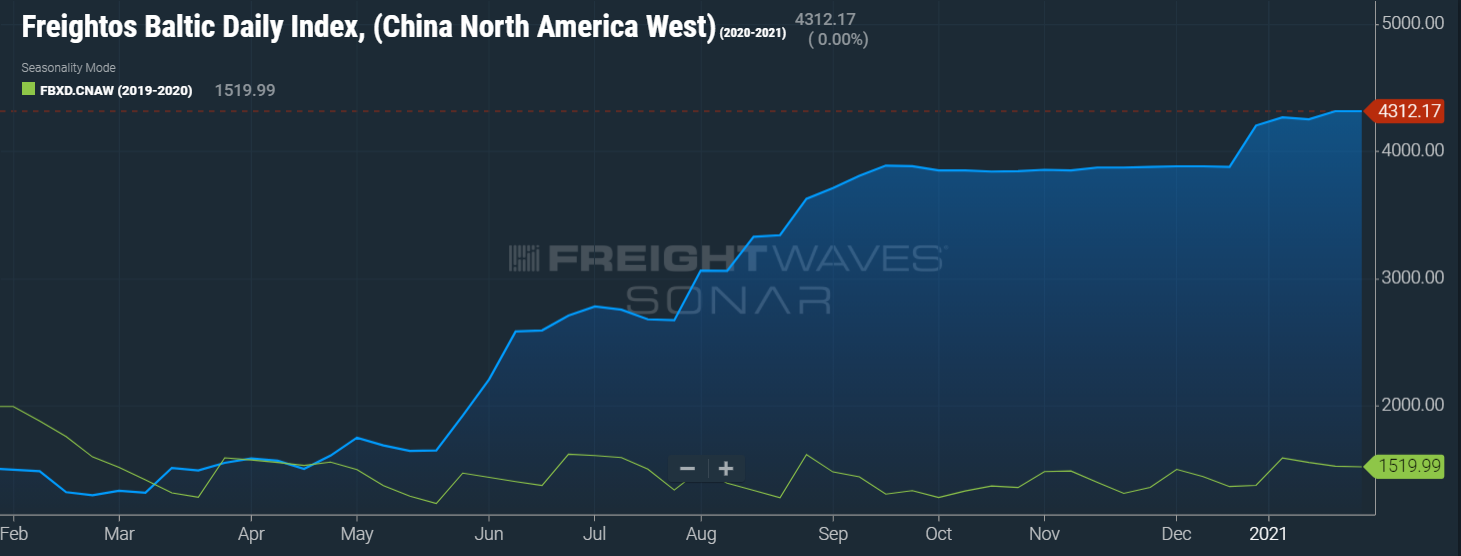

Inbound Cargo To Affect Truckload Shipping

We closely monitor inbound cargo volume arriving from overseas because a lot of those shipments turn into full truckloads or are shipped via rail, then shipped via FTL into or out of distribution centers or manufacturers.

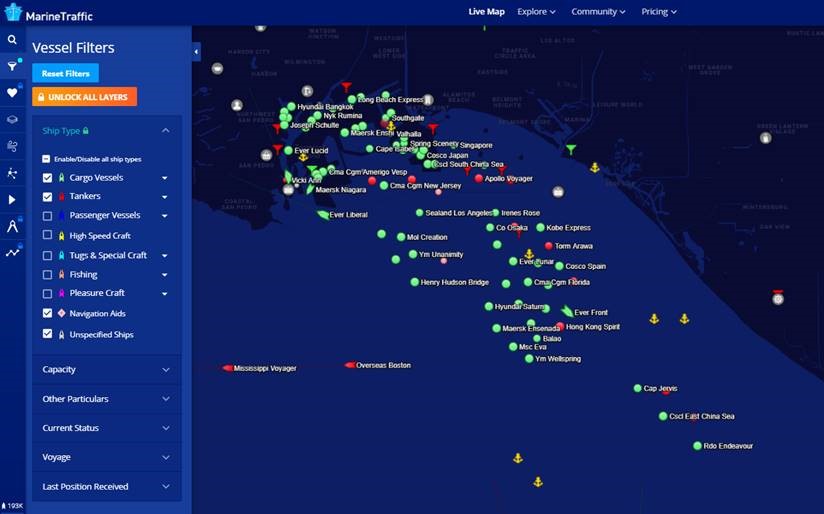

There is a significant situation currently happening at one of the major inbound ports. The Port of Long Beach has seen an “Unprecedented Amount of Cargo Volume” as the backlog of orders are still arriving due to the aforementioned shift in consumer spend. Los Angeles County also happens to be at the epicenter of the current COVID outbreak. Around 700 dockworkers at the ports of Los Angeles and Long Beach have contracted the Coronavirus and hundreds more have taken virus-related leaves. “We’ve got more cargo than we do skilled labor,” Eugene Seroka, executive director of the Los Angeles port, told the Los Angeles Times last week. “We are told 1,800 workers are not going on the job due to Covid right now. That can [include] those who are isolating through contact tracing or awaiting test results. Or maybe [those who] fear going on the job when a lot of people are sick.”

What this tells us is that there are a number of vessels sitting off the coast of our country waiting to unload. Some vessels are being redirected to Seattle and some to the East Coast, further delaying arrival of long-awaited shipments. We predict that a lot of these arrivals will opt to ship via truck instead of intermodal in order to arrive at their destination faster than they would via intermodal.

What this tells us is that there are a number of vessels sitting off the coast of our country waiting to unload. Some vessels are being redirected to Seattle and some to the East Coast, further delaying arrival of long-awaited shipments. We predict that a lot of these arrivals will opt to ship via truck instead of intermodal in order to arrive at their destination faster than they would via intermodal.

In addition to the backlog of shipments, there is talk of another shutdown in China due to COVID. Therefore many overseas manufacturers are trying to push out as much as possible in preparation for another potential shutdown, and before the Chinese New Year in February. The supply and demand for containers are short with the backlog and surge of shipments, driving cost up there as well. For example, containers that would have once cost $2,000 pre-COVID to cross the Pacific are now being quoted as high as $13,000 before the Chinese New Year.

All of this tells us that the spot rates that were starting to decrease slightly will likely be back up in February before starting a slow, downward trend in March.

At MegaCorp we continue to pledge to provide reliable service to our clients. You can trust that we

will deliver in any market.

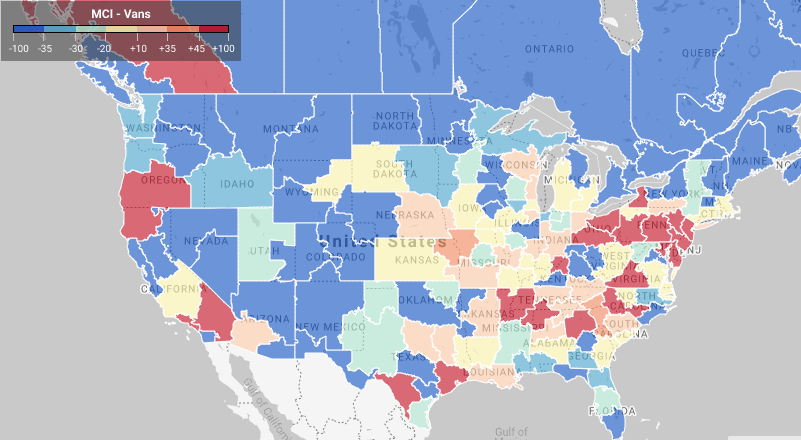

Load to truck ratio from the prior 7-day average:

About MegaCorp

MegaCorp Logistics, founded by Denise and Ryan Legg in 2009, specializes in full truckload shipments (dry van, refrigerated, flatbed, intermodal, etc.) and less-than-truckload shipments throughout the US, Canada, and Mexico. MegaCorp is committed to creating long-term, strategic partnerships with our clients who range from Fortune 100 companies to regional manufacturers and distributors. We serve all business sectors of the US economy including (but not limited to) food, retail, government, textiles, and metals/building materials. We strive to offer the best to our clients, transportation partners, and employees– It’s the Mega Way!

For a shipping quote, please CLICK HERE.