Safe Driver Week and Freight Volumes Holding Strong

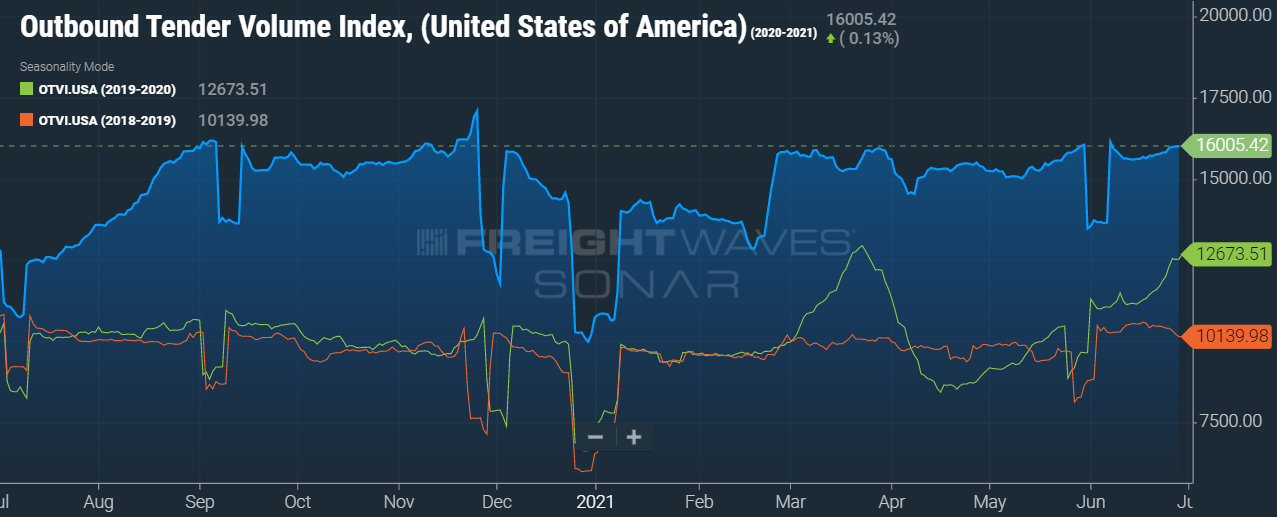

Another month has passed, but we remain in the same volatile freight market. Freight volumes continue to hold strong at near record levels. For the 17th week in a row, tender volumes are above 15,000 (except for the post-Memorial holiday dip) and coming in at just over 16,000 on June 29. As depicted within the chart to the right, volumes are up 26% year-over-year. Last year shipments were already drastically increasing due to the pandemic and shift in consumer spend. Compared to pre-pandemic times in June 2019, freight volume is up 59%.

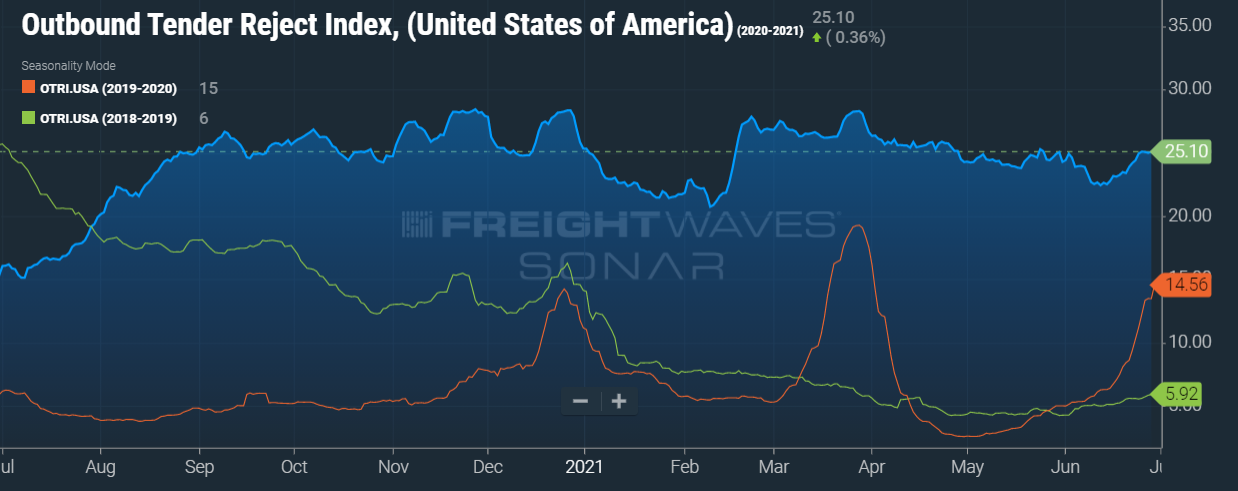

The Tender Rejection Index still indicates that one in four loads are tendered but not picked up as scheduled within 24 hours. The current tender rejection rate is 25.10%. This is the 48th week in a row that the Rejection Index is above 20%. Volume and rejections will continue on an upward trend before the 4th of July, decrease for about a week and then return to near where they are now.

The United States continues to battle a labor shortage, reporting over 9 million available jobs in April 2021. Many frontline workers are afraid to return to work, fearing exposure to COVID, or roundly rejecting low, hourly wages. Many of these frontline workers are tied to the transportation industry by way of pickers, packers and dock workers. The decrease in available labor resources has led to detention at shippers and receivers, causing truck rates to increase. The longer wait times at shippers

and receivers further exacerbate the capacity shortage when a truck that could, for example, complete three shipments per week can now only complete two shipments.

Additionally, the Safe Driver Week performed by the Commercial Vehicle Safety Alliance (CVSA) will be July 11 to July 17. The primary focus of this safety check will be speeding. In addition to speeding, law enforcement personnel will be tracking other dangerous driver behaviors throughout Operation Safe Driver Week, such as reckless or aggressive driving, distracted driving, following too closely, improper lane change, failure to obey traffic control devices, failure to use a seat belt and evidence of driving under the influence. This will remove some capacity from the supply chain, putting additional strain on availability and pricing. Especially because the industry is still in an overall “spot-dominant” market where spot rates are out-performing the rising contract rates creating an inverted market, further elevating costs.

The backlog and abundance of maritime freight arriving at the ports are still breaking records, signifying that the previously discussed, elevated freight volumes are not going anywhere. For example, loaded imports into LA were up 75% year-over-year for the month of May. The charts below show what is scheduled to arrive to our East and West coasts from just China. Maritime shipments are steadily arriving in abundance. These factors will keep capacity at historically tight levels and record-breaking freight costs. As always, MegaCorp is here to help. You can rely on us in any market and trust that wewill deliver.

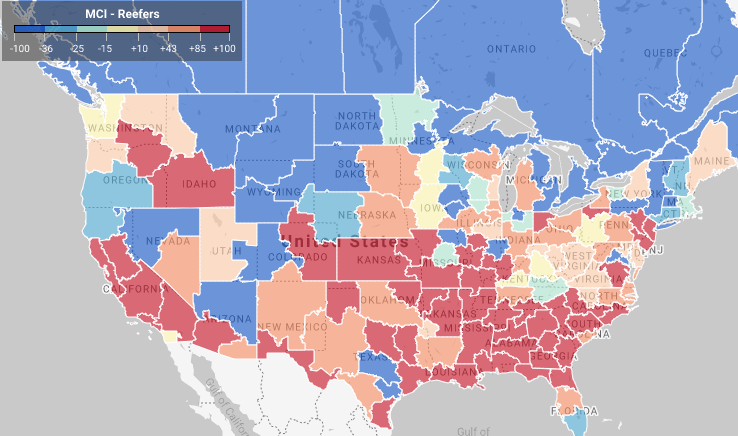

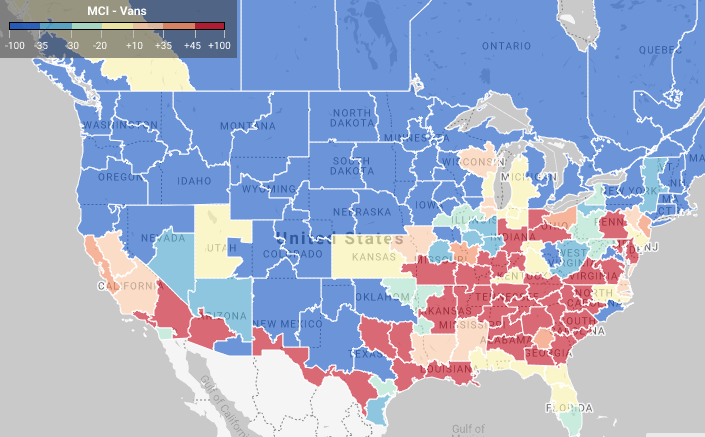

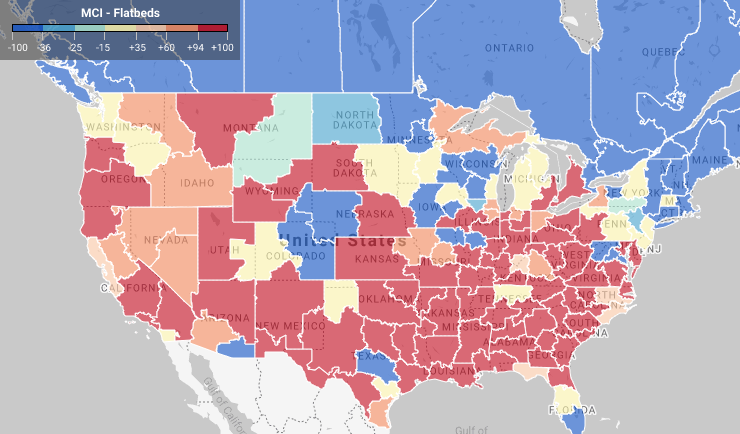

Load to truck ratio from the prior day average.

The charts below are load to shipment ratios. For example, red indicates one truck for every 45+ shipments.

MegaCorp Logistics, founded by Denise and Ryan Legg in 2009, specializes in full truckload shipments (dry van, refrigerated, flatbed, etc), less-than-truckload, and intermodal shipments throughout the US, Canada, and Mexico. MegaCorp is committed to creating long-term, strategic partnerships with our clients who range from Fortune 100 companies to regional manufacturers and distributors. We serve all business sectors of the US economy including (but not limited to) food, retail, government, textiles, and metals/building materials. We strive to offer the best to our clients, transportation partners, and employees– It’s the Mega Way! You can trust that we will deliver.

For a shipping quote, please CLICK HERE.