The Peak Is Here To Stay

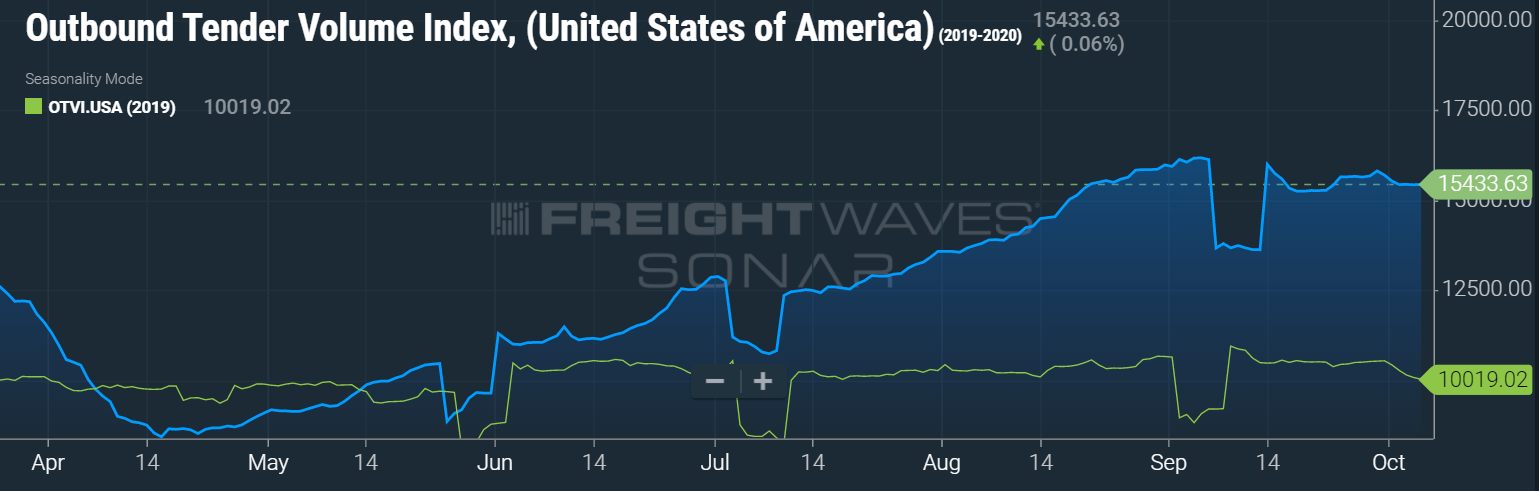

Freight volumes are holding steady overall, with approximately 45%-50% more freight on the road, weekly, than this time last year. This steady influx of truckloads isn’t going anywhere anytime soon, especially with the approaching holidays.

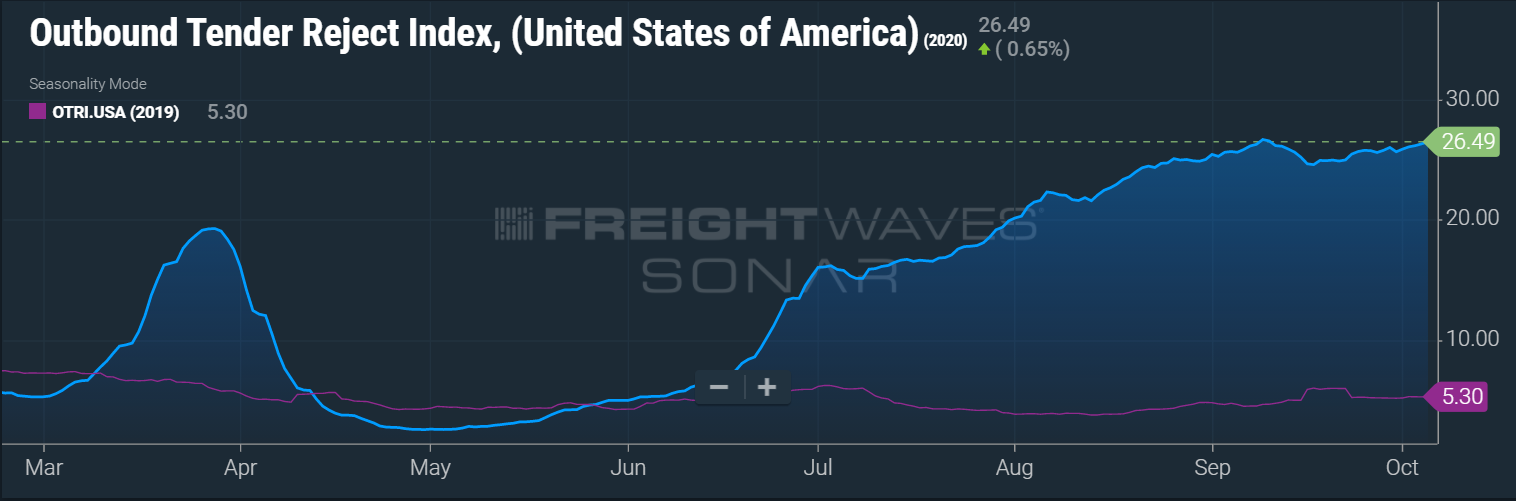

The increased volume has certainly elevated the tender rejection rate. For the past two months, the average rejection rate has been 1 in 5 to 1 in 4 loads being turned down by carriers, compared to 2019 (in purple) when only 1 in 20 loads was being turned down. Currently, the tender rejection rate is at 26.45% with 1 in 4 shipments being turned down or left on the dock as carriers accept higher paying loads (as a reminder, MegaCorp will not leave loads on the dock once committed to picking up a load).

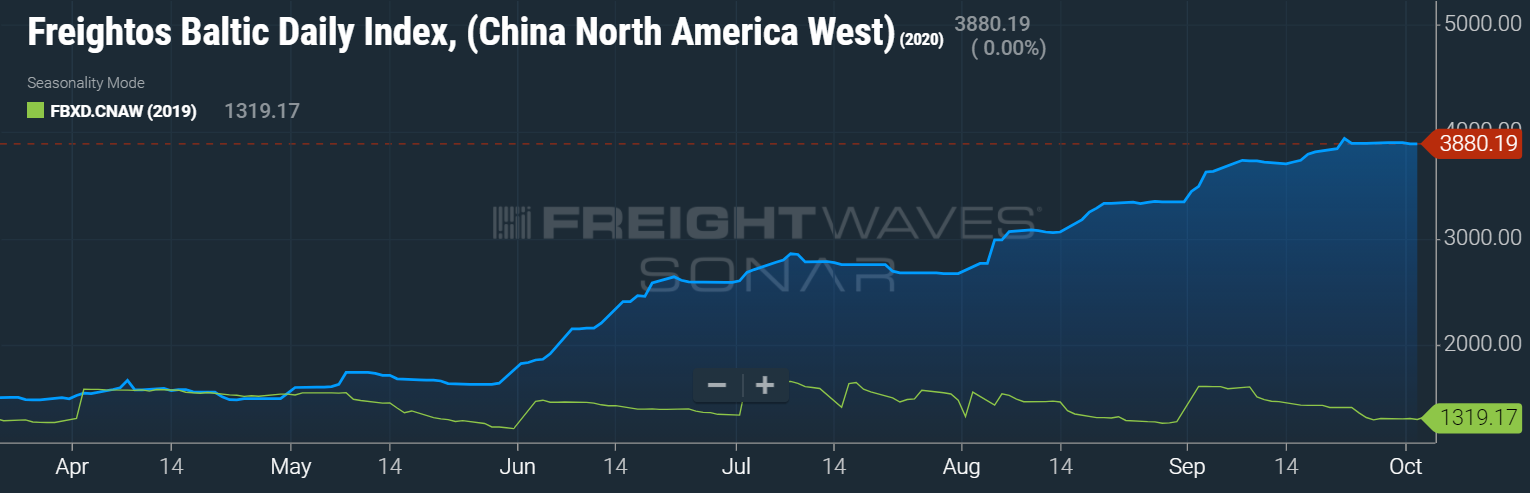

This is a whopping 400% increase in the Tender Rejection Index year-over-year. Also noteworthy is that there is a lot more freight on its way from overseas (graph to the right) that will continue to feed into the capacity strain.

Spot vs. Contract

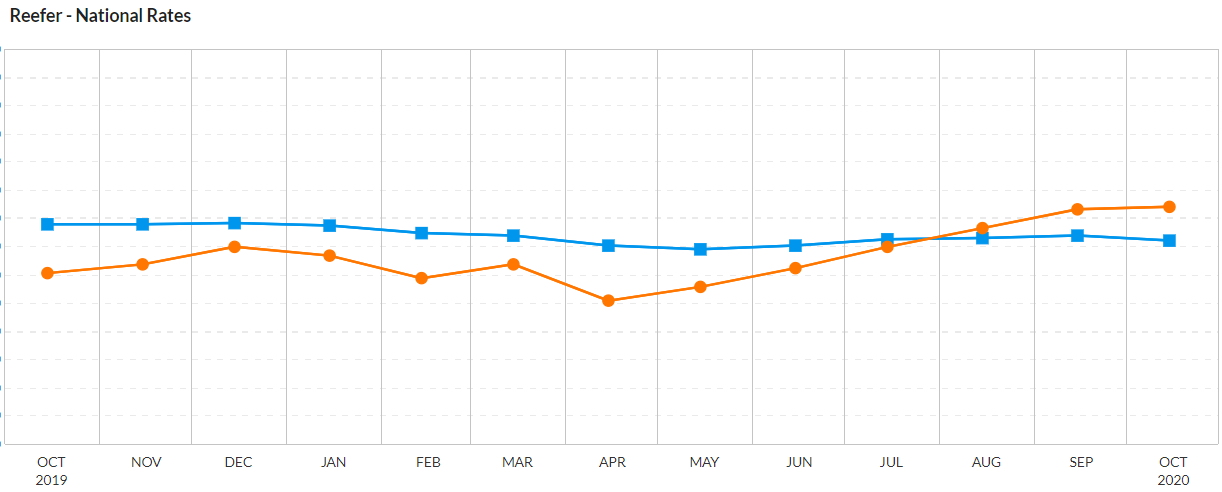

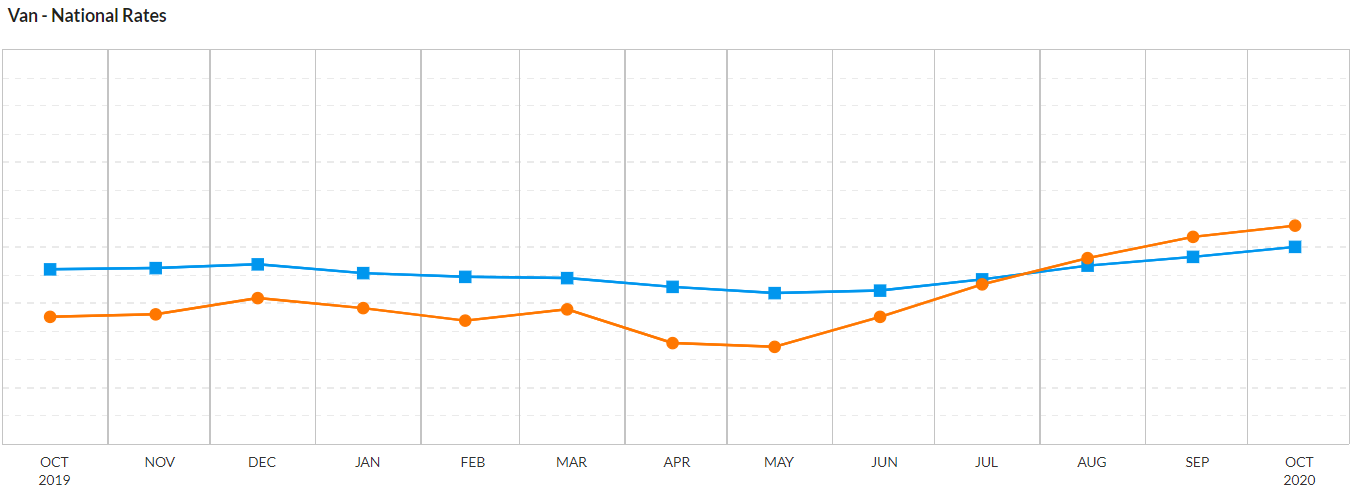

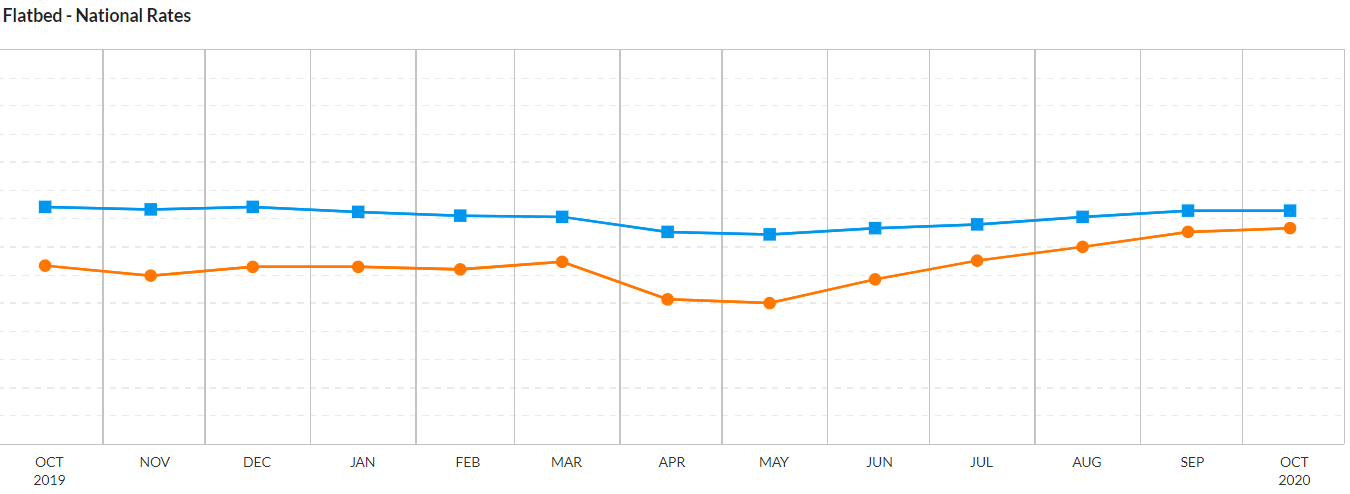

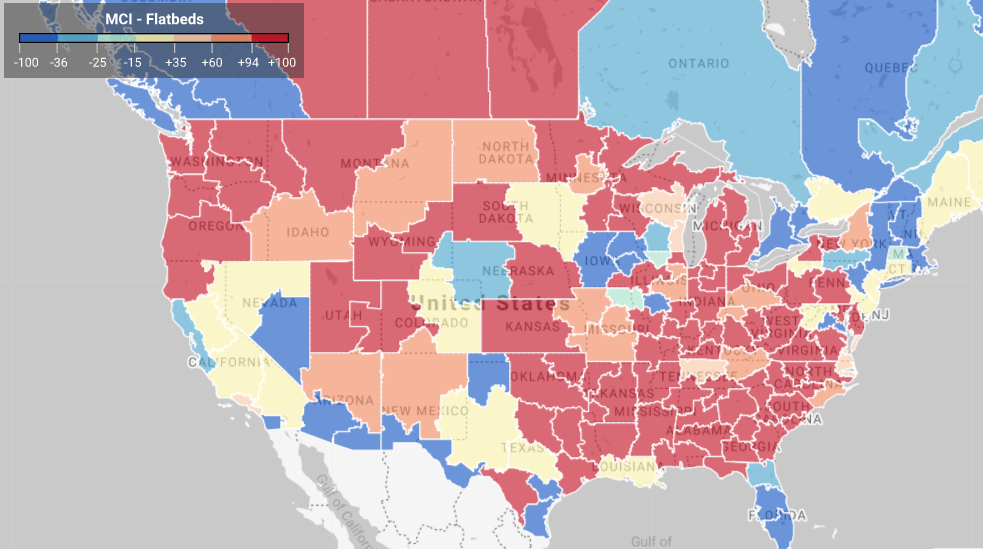

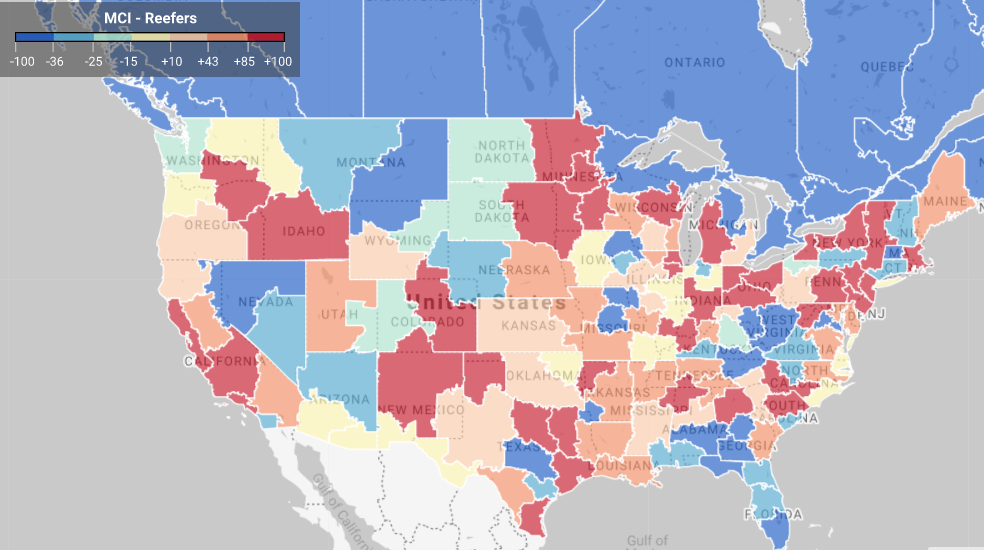

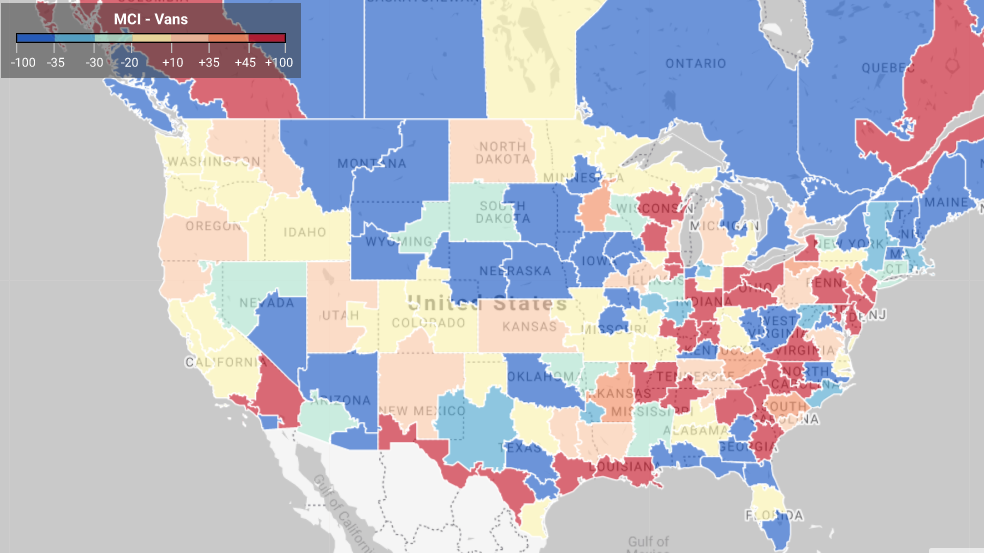

The new “standard” of rejection rates is strong enough to keep spot rates high which also has an impact on the upswing in tender rejections, even when there is a slight dip in overall freight volumes. Spot rates are more than contracted rates which is making it easy for carriers to turn down contract rate loads to pick up the higher-priced spot loads, keeping rates elevated. The chart below hows when spot rates started out-pricing contract rates in July, which is when we started seeing a greater spike in tender rejections and spot rates still increasing. This increase is happening in all truckload modes. Van and flatbed charts are below. It’s important to note that even the contract rates are slightly increasing, indicating that shippers are holding mini-bids and adjusting their rates to remain competitive and to keep up with the new “normal.” According to Truckstop.com data, the national average for reefer rates is up 38% year-over-year, van rates are up 39.8% year-over-year, and flatbed rates are up 10% year-over-year.

Orange = Spot, Blue = Contract

Load to truck ratio from the prior 7-day average.

About MegaCorp

MegaCorp Logistics, founded by Denise and Ryan Legg in 2009, specializes in full truckload shipments (dry van, refrigerated, flatbed, intermodal, etc.) and less-than-truckload shipments throughout the US, Canada, and Mexico. MegaCorp is committed to creating long-term, strategic partnerships with our clients who range from Fortune 100 companies to regional manufacturers and distributors. We serve all business sectors of the US economy including (but not limited to) food, retail, government, textiles, and metals/building materials. We strive to offer the best to our clients, transportation partners, and employees– It’s the Mega Way!

For a shipping quote, please CLICK HERE.