Tidal Wave Of Freight On The Way

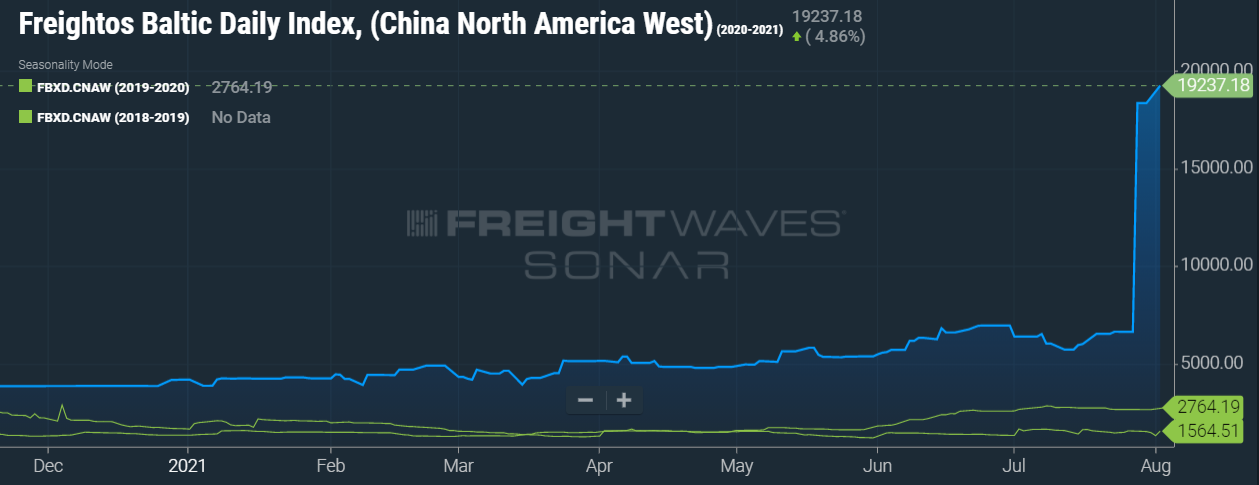

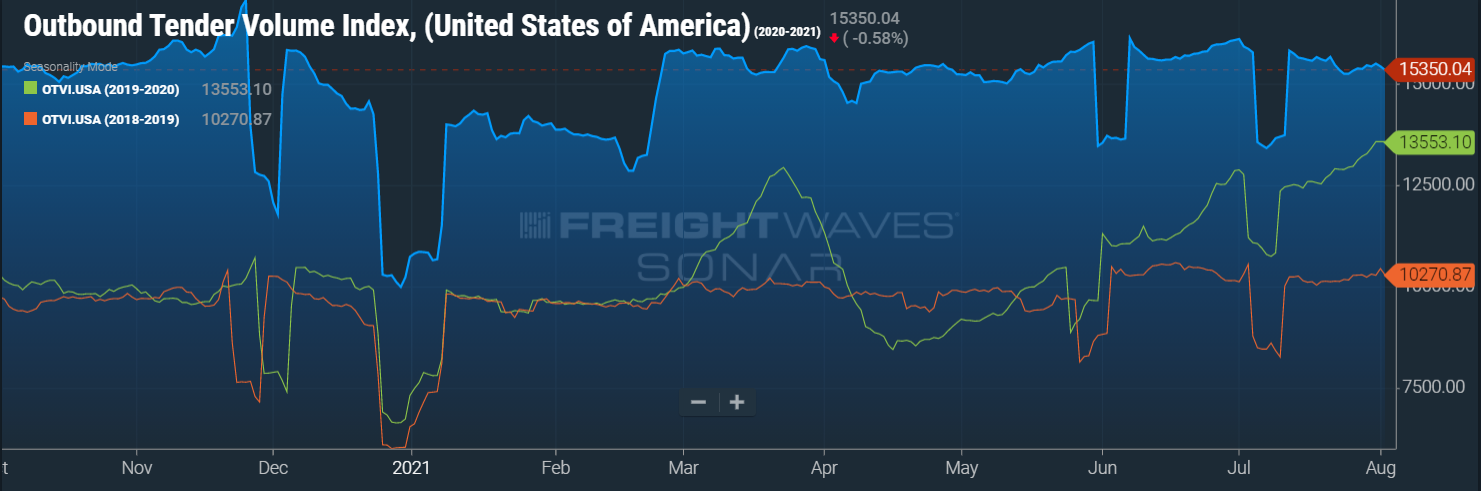

When analyzing trends and patterns of the domestic supply chain, we expand our research to encompass a global view. We do this to look at what is or isn’t making its way to the US, because 95% will end up on a truck at some point. We have become accustomed to backups at the ports and about 50% more freight on the road now versus pre-COVID times. Red heat maps, high costs, and elevated tender rejection rates are seemingly considered normal now. However, it is absolutely alarming to look at the extreme jump in maritime shipments headed to the US East coast (top right) and the US West coast (bottom right), and these are just from China, do not include all other countries that export to the US. There was already an extreme increase in port shipments over the last year, enough to cause backlog and disruption to the supply chain. However, this new surge is going to throw a wrench into an already fragile market that was just starting to show small signs of relief.

Q2 2021 ocean volumes increased 15% year-over-year, with average freight rates surging 59%. On top of that, volumes from China to the US are up 65% in the past week. Some of this is the backlog of orders from the shift in consumer spend due to COVID. This includes, but is not limited to: home goods, home improvement and construction, manufacturing, equipment, and parts. This also includes an abundance of new orders so shippers and manufacturers do not end up in the same situation they are in now in the future – waiting on parts and goods to fulfill orders – especially with the holiday season a few months away.

These shipments will start drastically impacting our supply chain by the end of August, with no long-term pricing relief in sight for the remainder of 2021. Not only will the capacity crunch become more volatile, but storage space will also be harder to come by because an estimated half of these orders will require storage until they are needed.

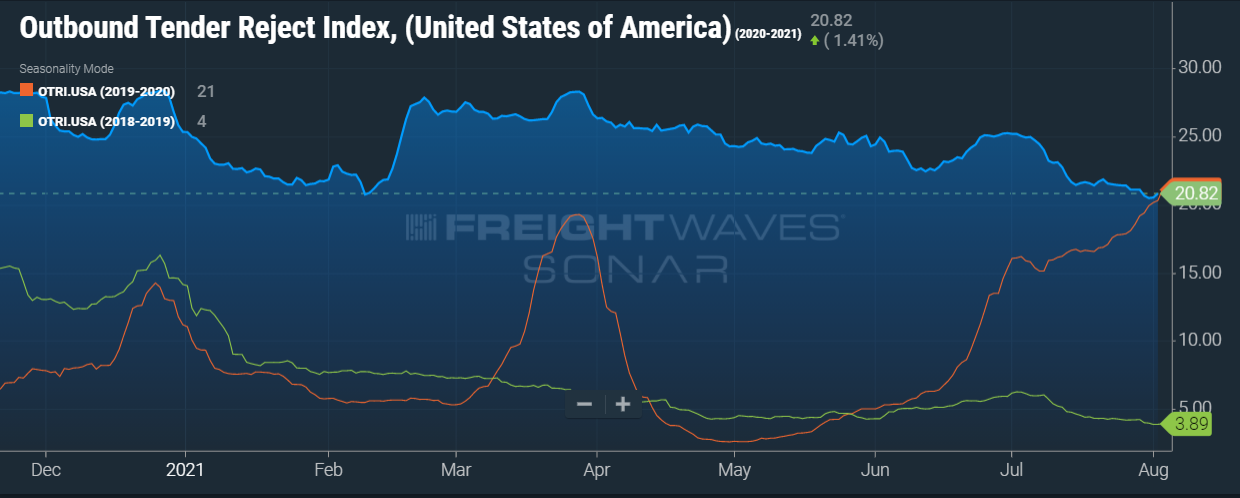

The Outbound Tender Volume continues to shatter records for this time last year; when this time last year we were shattering previous records. On a positive note, the Outbound Tender Rejection Index has been showing signs of slight relief and is currently coming in at 20% which of course is still pretty volatile. However, shippers should take advantage of this temporary decrease in rejections and slight loosening over the next few weeks before this “tidal wave” of freight arrives and further impacts capacity.

These factors will keep capacity at historically tight levels and will cause record-breaking freight costs. As always, MegaCorp is here to help. You can rely on us in any market and trust that we will deliver.

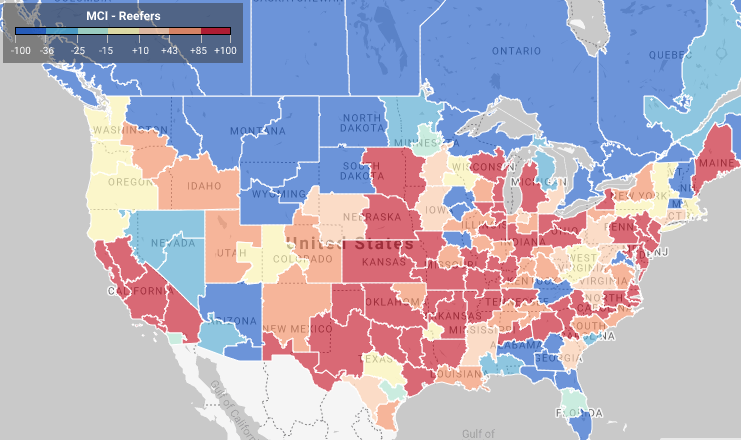

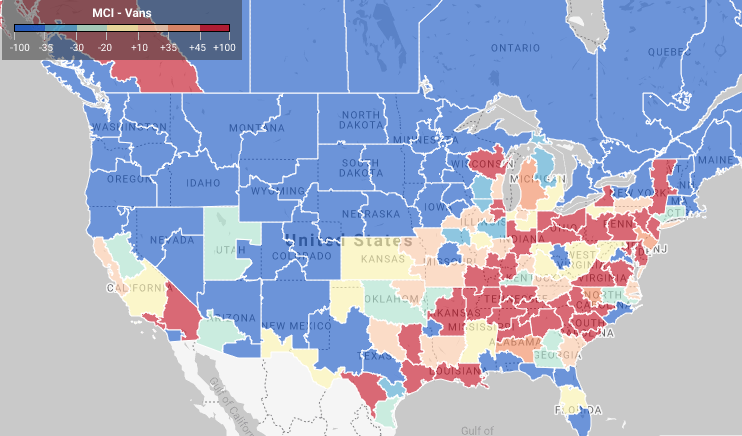

Load to truck ratio from the prior day average.

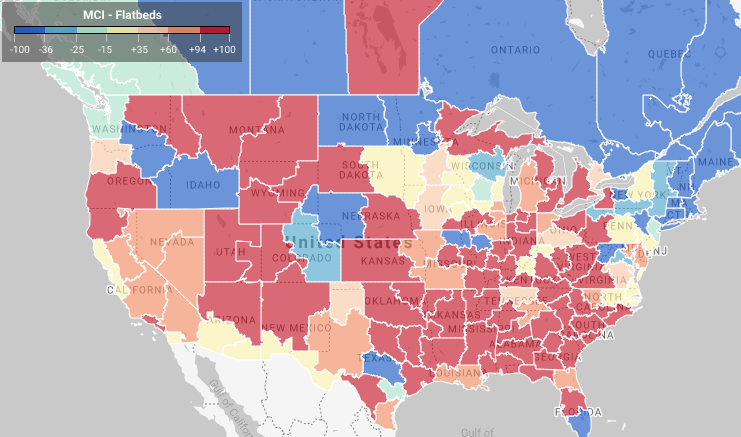

The charts below are load to shipment ratios. For example, red indicates one truck for every 45+ shipments.

MegaCorp Logistics, founded by Denise and Ryan Legg in 2009, specializes in full truckload shipments (dry van, refrigerated, flatbed, etc), less-than-truckload, and intermodal shipments throughout the US, Canada, and Mexico. MegaCorp is committed to creating long-term, strategic partnerships with our clients who range from Fortune 100 companies to regional manufacturers and distributors. We serve all business sectors of the US economy including (but not limited to) food, retail, government, textiles, and metals/building materials. We strive to offer the best to our clients, transportation partners, and employees– It’s the Mega Way! You can trust that we will deliver.

For a shipping quote, please CLICK HERE.