Preparing For The Crest Of The Peak

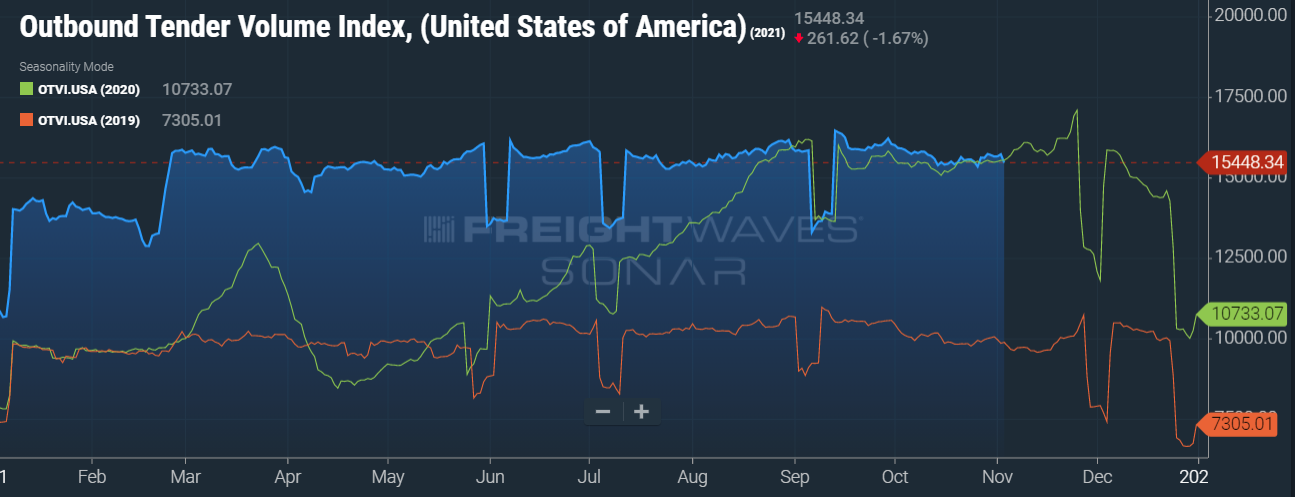

The traditional “Peak Season” is upon us and we are exactly where we were one year ago in regards to freight volume, which is 57.05% more shipments than any given day in the 2019 Holiday Season. We have essentially been in a “peak season” since July of 2020 but, unlike other months, a sharp uptick in shipments is on the way for the remainder of November. There should be a 15% jump in volume year over year throughout the next few weeks.

The traditional “Peak Season” is upon us and we are exactly where we were one year ago in regards to freight volume, which is 57.05% more shipments than any given day in the 2019 Holiday Season. We have essentially been in a “peak season” since July of 2020 but, unlike other months, a sharp uptick in shipments is on the way for the remainder of November. There should be a 15% jump in volume year over year throughout the next few weeks.

The upcoming, predicted jump in year-over-year volume stems from the return of pre-pandemic brick-and-mortar retail sale numbers, on top of the steadily growing e-commerce sales, continuously strong manufacturing, packaged foods, housing and home improvement industries.

“We are seeing clear signs of a strong and resilient economy,” National Retail Federation (NFR) Chief Economist, Jack Kleinhenz said. Given the strength of consumer spending, Kleinhenz noted he anticipates the fastest growth the U.S. has experienced since 1984. The reopening of the economy accelerated much faster than most had believed possible, even a year ago. The NFR, projects that 2021 non-store and online sales will grow another 18-23 percent to $1.09-1.13 trillion. Retailers should also expect significantly more e-commerce order volume this quarter. Total retail sales are expected to exceed $4.44 Trillion in 2021. This compares with $4.02 trillion in total retail sales in 2020. Of that, $920 billion was from purchases made through non-store and online channels.

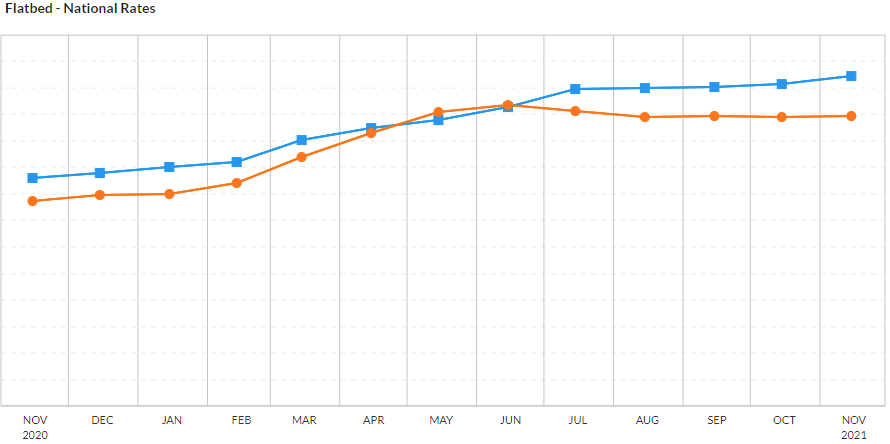

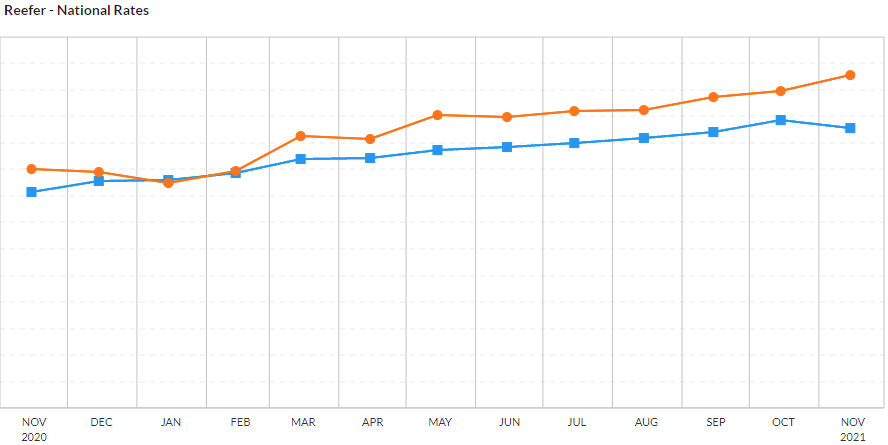

Inventory-to-sales ratios across all sectors of the economy remain historically low. Consumer spending has been so abundant that shippers have been struggling to keep up with demand while trying to stay ahead of the supply chain disruptions and delays they experienced last holiday season. Correspondingly, shippers across the board have been (overall) increasing their contract rates in an attempt to compete with the ever-climbing spot-rates. November rates will continue to rise for most markets the closer we get to Black Friday.

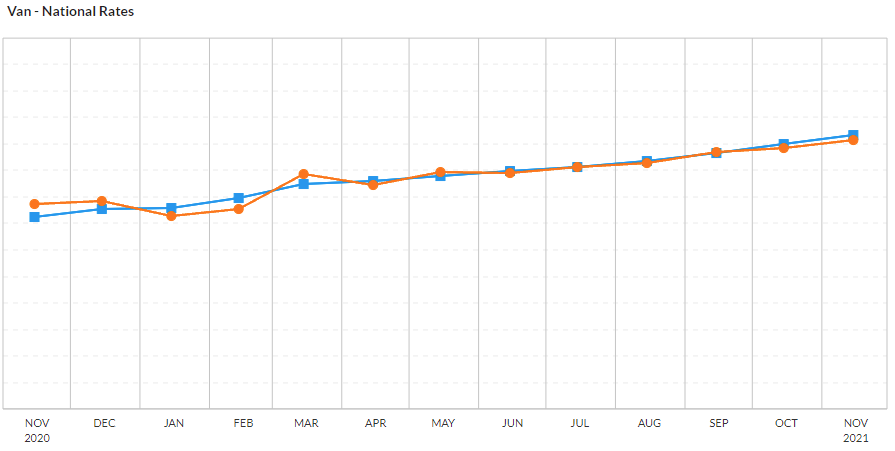

Reefer year-over-year spot rates are up 26.3%. Reefer year-over-year contract rates are up 19.97%. Reefer spot rates are up 3.65% from last month. Reefer contract rates are down 1.95% from last month. Van year over year spot rates are up 19.59%. Van year over year contract rates are up 26.83%. Van spot rates are up 2.09% from last month. Van contract rates are up 2.09% from last month. Flatbed year-over-year spot rates are up 26.22%. Flatbed year-over-year contract rates are up 29.39%. Flatbed spot rates are up .32% from last month. Flatbed contract rates are up 1.08% from last month. The more lead time shippers can give, for a pickup and the earlier in the month that shipments can be made, the better off that they will be. As expected, the market will only tighten as we move through November.

These charts show trends in cost in spot rates (orange) and contract rates (blue) month over month:

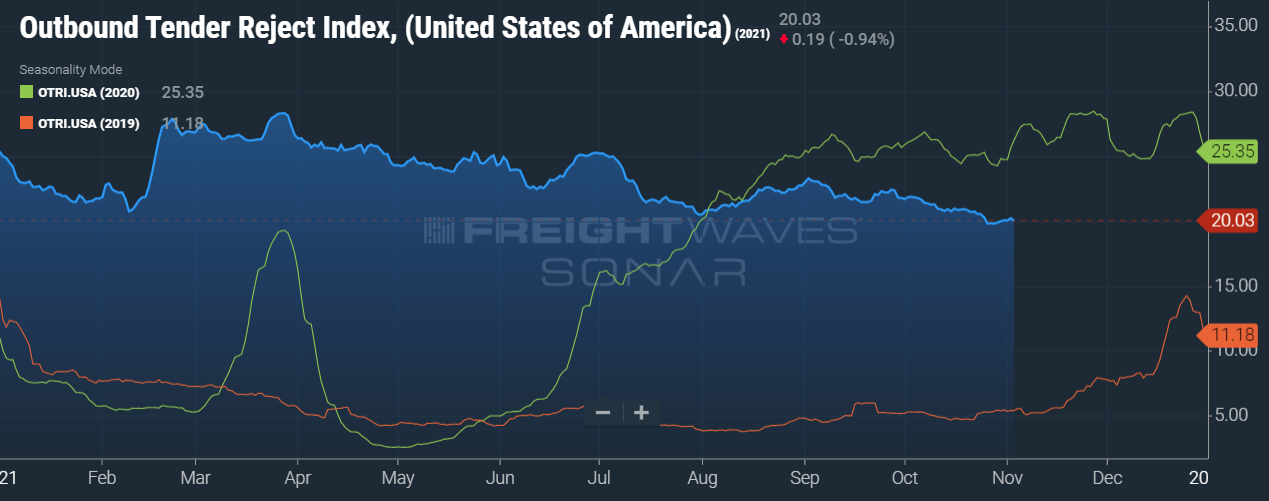

The silver lining is that rejections are down year over year, coming in at 20.03% instead of the 25.35% they were at this time last year due to the overall increase in contract rates, but we are still in an inverted market where spot rates are out-performing contract rates by a significant amount in Van and Reefer loads.

The silver lining is that rejections are down year over year, coming in at 20.03% instead of the 25.35% they were at this time last year due to the overall increase in contract rates, but we are still in an inverted market where spot rates are out-performing contract rates by a significant amount in Van and Reefer loads.

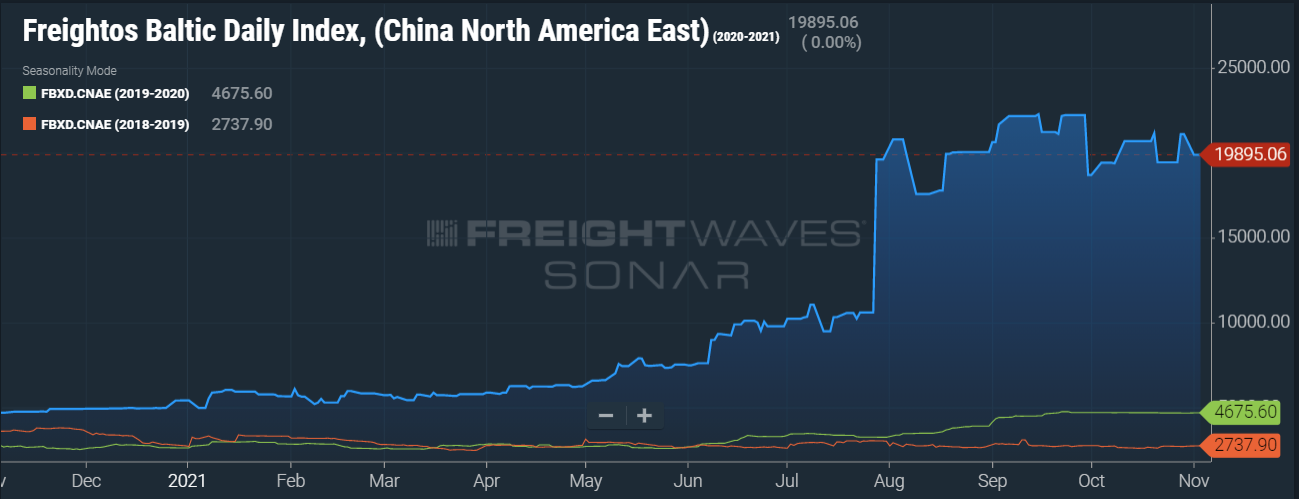

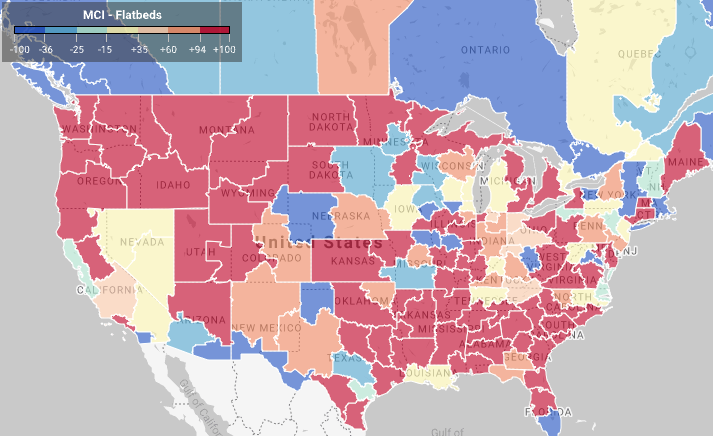

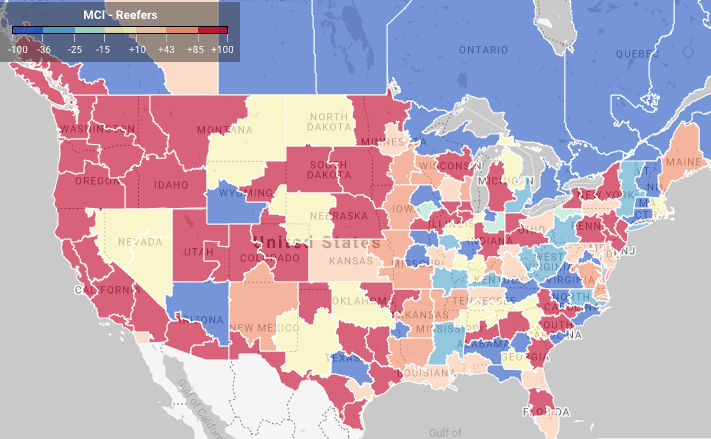

Maritime import shipment volumes are a leading indicator of incoming demand pools within domestic surface side transportation, and there is no shortage of what is headed to the US as shown in the charts below. As always, MegaCorp is here to help. You can rely on us in any market and trust that we will deliver.

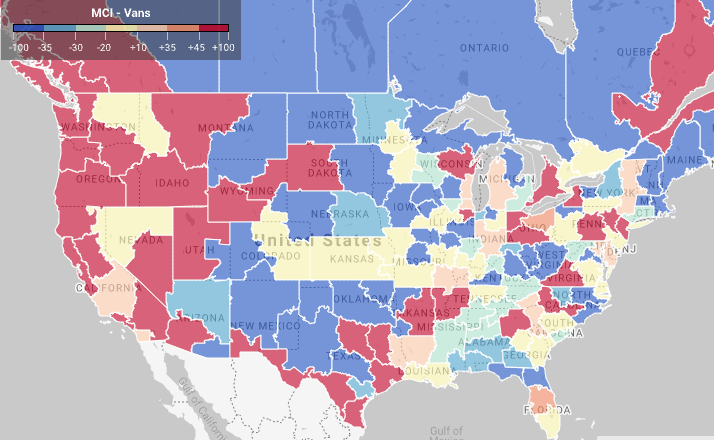

Load to truck ratio from 11/4/2021.

The charts below are load to shipment ratios. For example, red indicates one truck for every 45+ shipments.

About MegaCorp Logistics

MegaCorp Logistics, founded by Denise and Ryan Legg in 2009, specializes in full truckload shipments (dry van, refrigerated, flatbed, etc), less-than-truckload, and intermodal shipments throughout the US, Canada, and Mexico. MegaCorp is committed to creating long-term, strategic partnerships with our clients who range from Fortune 100 companies to regional manufacturers and distributors. We serve all business sectors of the US economy including (but not limited to) food, retail, government, textiles, and metals/building materials. We strive to offer the best to our clients, transportation partners, and employees– It’s the Mega Way! You can trust that we will deliver.

For a shipping quote, please CLICK HERE.