Consumer confidence, ELDs and the driver shortage are driving the tight truck market.

Increased Tonnage and Volume due to Consumer Confidence

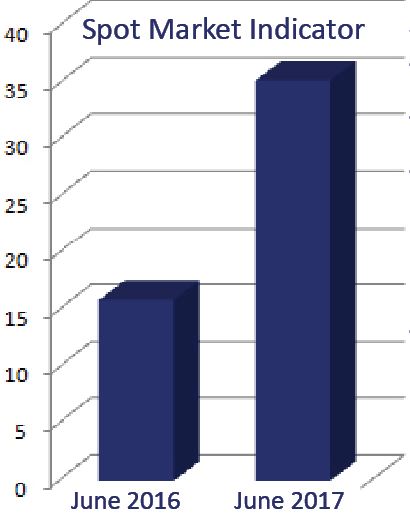

According to the Market Demand Index (graph to the left), the spot market indicator rose to 35.3 in the last weekly update, compared to one year ago when the index was at 15.9. Correspondingly, the seasoned account managers at MegaCorp Logistics are reporting that this is the most active spot load market they have seen in their careers. These figures, and the statics below, show that the spot market favors a pro-truck versus a pro-shipper market which is contributing to the tight truck market.

According to the Market Demand Index (graph to the left), the spot market indicator rose to 35.3 in the last weekly update, compared to one year ago when the index was at 15.9. Correspondingly, the seasoned account managers at MegaCorp Logistics are reporting that this is the most active spot load market they have seen in their careers. These figures, and the statics below, show that the spot market favors a pro-truck versus a pro-shipper market which is contributing to the tight truck market.

Truck tonnage rose 4.8% in May 2017 and when compared with one year ago, is the largest year-over-year gain since November 2016, according to Transport Topics and the American Trucking Associations index. This feeds in to the tightening freight market.

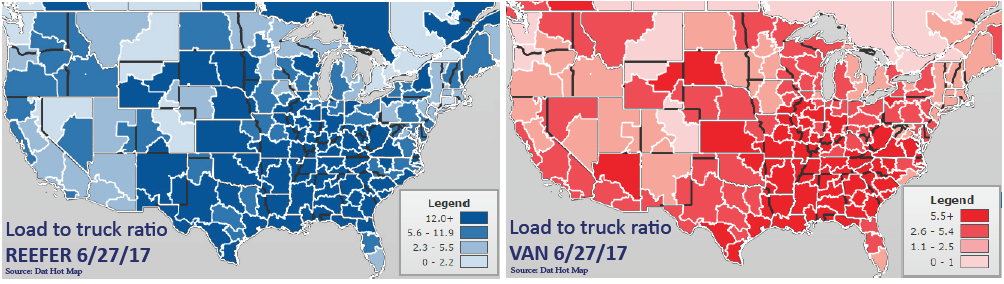

The DAT Trendlines report (also a spot market indicator) shows spot market loads were up 100% May 2017 vs. May 2016. The load-to-truck ratio, or the number of loads for every one available truck, increased 109% in dry van, 117% in flatbed and 98% in reefer year-over-year.

Electronic Logging Devices (ELD’s)

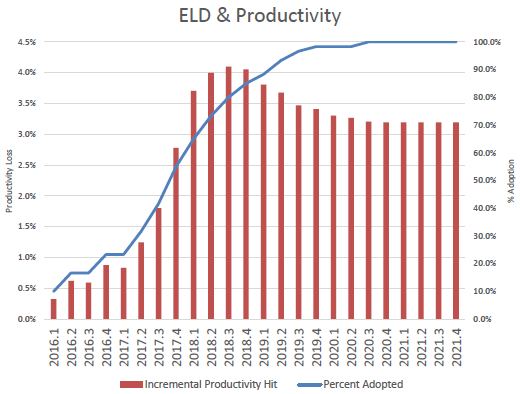

The June 2017 3PL Summit predicted that ELD’s will take 2.5% – 10% of capacity off the road which is already taking effect. Before 12/18/17, MegaCorp will require carrier partners to sign and affidavit confirming the are ELD complaint.

Electronic logging is a major operational and cultural change for truck drivers, who have used paper logs to record their “duty status” since the 1930s. The transition to electronic logging devices or ELDs, which is expected to be complete by 2019, will pose challenges for shippers as well as trucking and logistics companies.

This will result in more precise logging and fewer opportunities to falsify logs and get away with it, which will mean tighter delivery schedules for

shippers and less inherent flexibility in supply chains. Trucking operators and their customers will be pressed to improve route planning and reduce detention time at shipper customers and consignees. -JOC

The Driver Shortage

The average age of today’s trucker is 49, which means more and more drivers are retiring from the industry. According to the American Truckers Association, there are currently 48,000 unfilled truck driving positions.

Most shippers want to pay the lowest cost possible for transporting their goods. However, this results in lower profits for the carriers which results for lower wages for their drivers which feeds into the driver shortage and unreliable carriers. The Journal of Commerce states that the nationwide low unemployment rate and better wages among other industries are drawing people away from the trucking industry increasing the hassles of a tight truck market.

MegaCorp’s Observations

MegaCorp has noticed a large increase in the carrier demand for accessorial charges, which are up 30% for the year.

Carriers are much more selective in the loads they accept in order to avoid unpredictable and long loading and unloading times.

Diesel prices remain low, which should offset some of the cost increases that are accelerated by the tight market conditions.

At MegaCorp, we offer fair pricing backed with great value and reliability. To get a quote, please click here or call us at (877) 241-1649.