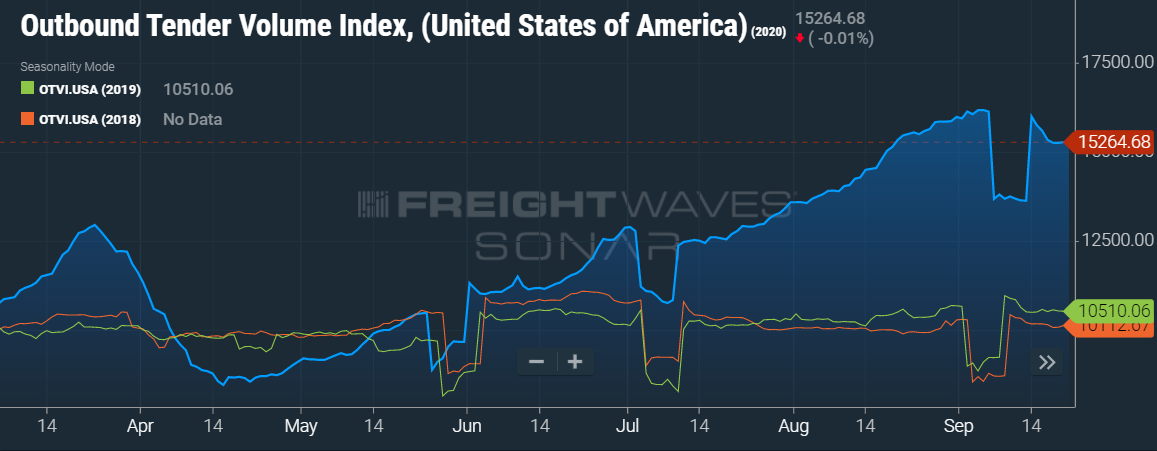

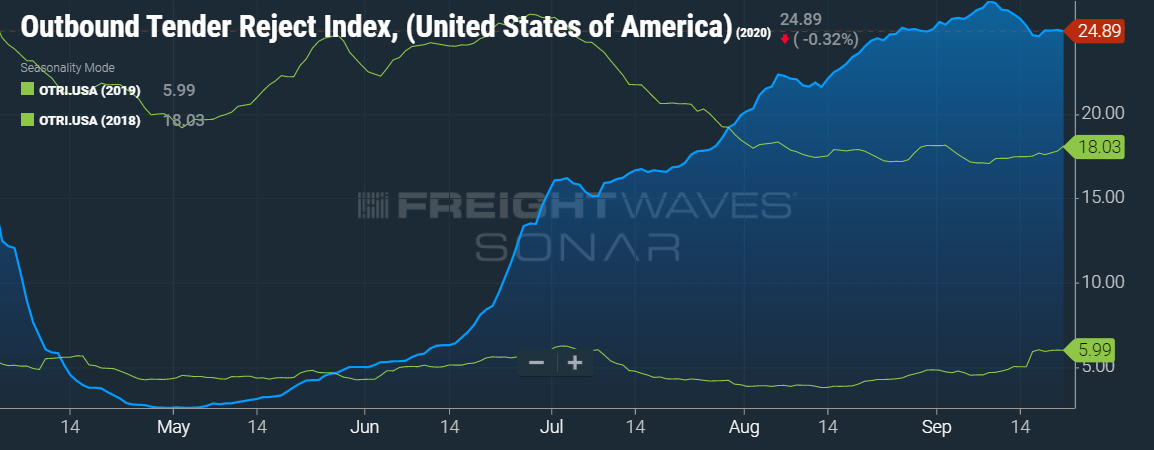

This week there is a good news/bad news situation for the freight market. The good news is that tender volumes are decreasing and tender rejections are coming down slightly. However, the bad news is that this means about one in four loads are still being rejected by carriers to seek even higher paying loads and/or more desirable lanes, and there are still 47% more loads on the road this year than this same time in 2019.

As a reminder, once MegaCorp commits to picking up a shipment, we will see that shipment through and will not leave it on the dock.

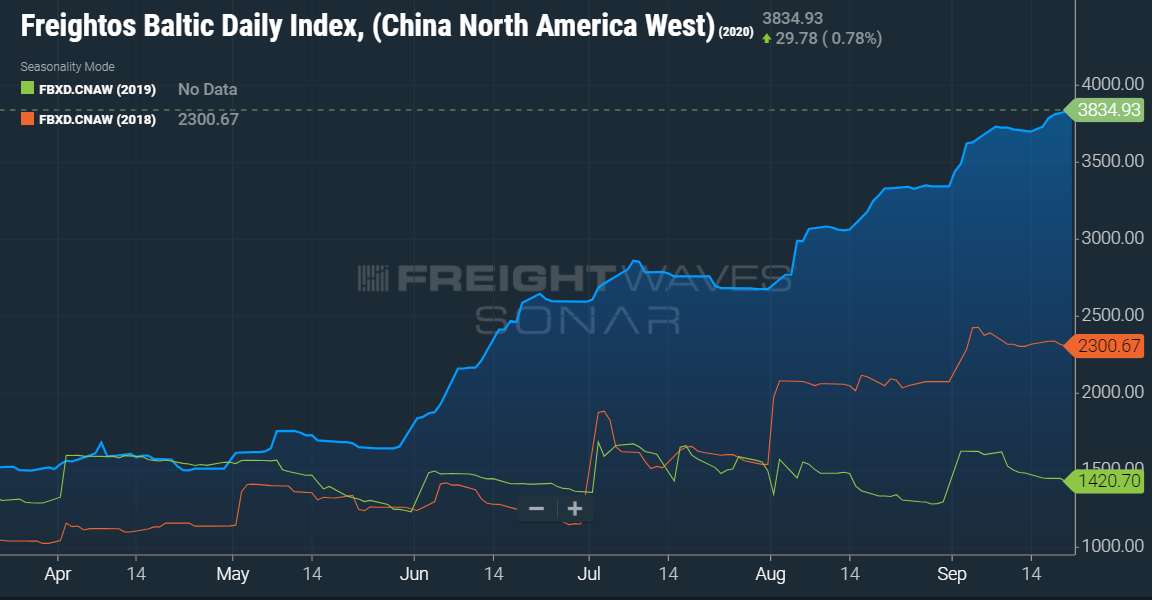

The damage has been done with this “new normal” of ballooned rates due to supply and demand, and these rates are not going anywhere anytime soon. There is still an abundance of container shipments on their way from overseas. Some of these shipments are part of the backlog of orders that were postponed due to COVID, but most of these headed to our west coast ports are simply keeping up with the new demand and new spending trends, also stemming from COVID. Buying trends have moved from service-based to tangible-based spend.

Rail is constantly completely booked, adding more long-haul shipments taking place over the road. When the aforementioned maritime shipments make their way to the west coast, they are typically long-haul shipments, which further displaces capacity adding additional strain to certain markets.

Rates

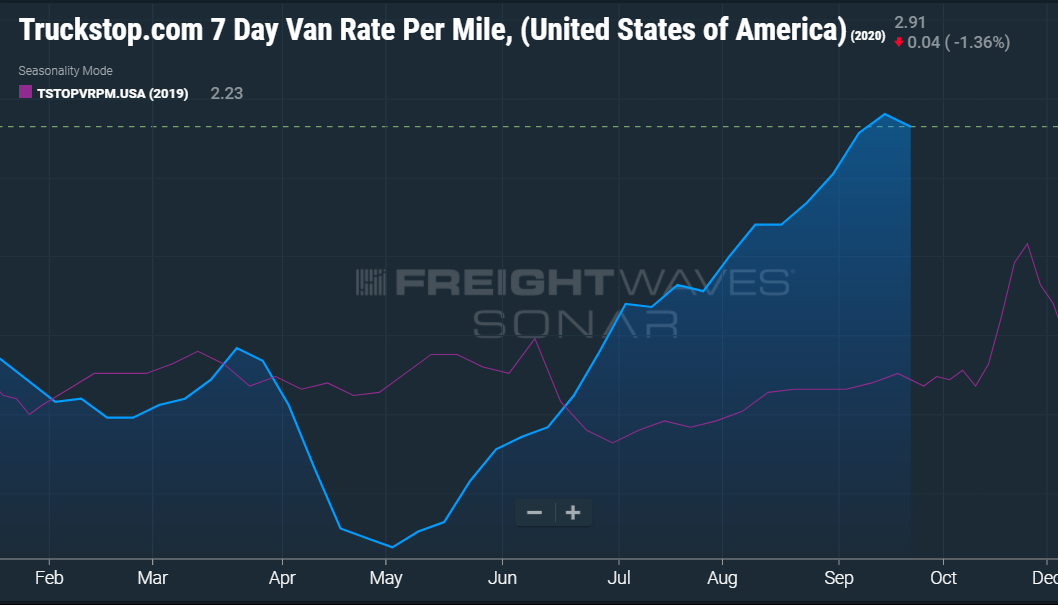

Rates, on average, are up 40% compared to this time last year. This week and next there is hope for a little decrease in the spot market pricing. However, be prepared for another (new) spike in pricing beginning in mid-October through December as holiday freight moves through the supply chain. The graph to the right shows where the national van average per mile is currently (blue) and where it was last year (purple). In 2019 you can see what is expected for the holiday season during a normal year. As a reminder, that is the average. Take LA to Dallas for instance. With the port being so active, prices are even more extreme out of CA.

To end on an encouraging note: Class 8 retail sales in the US hit their highest point for 2020 in August. This is still down 37.4% compared to last year’s YTD sales, but the good news is that carriers are growing their fleets which will help move the abundance of freight in a more cost-efficient manner as it starts to level out more in the first half of 2021.

Shippers should rely on logistics partners such as MegaCorp that do not give back loads or leave loads on the dock to eliminate unnecessary stress and costs.

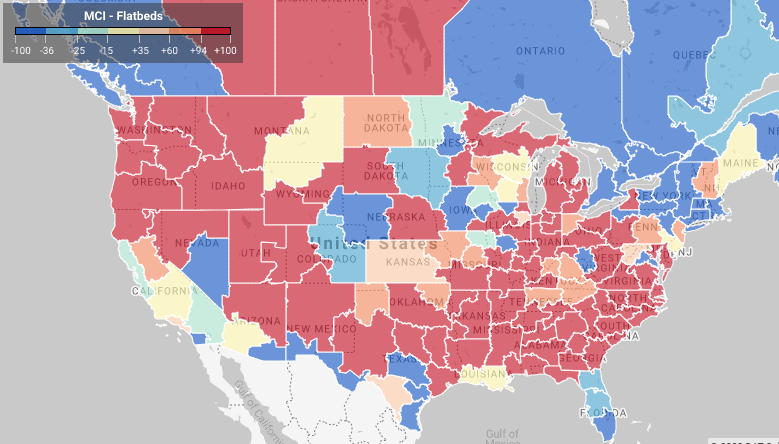

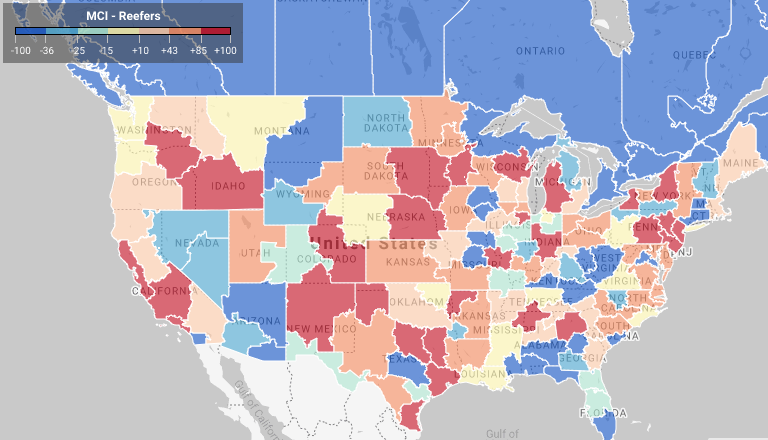

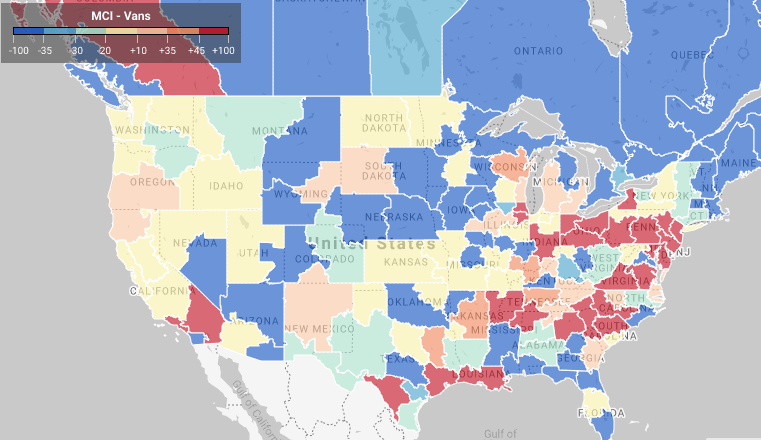

Load to truck ratio from the prior 7-day average.

About MegaCorp

MegaCorp Logistics, founded by Denise and Ryan Legg in 2009, specializes in full truckload shipments (dry van, refrigerated, flatbed, intermodal, etc.) and less-than-truckload shipments throughout the US, Canada, and Mexico. MegaCorp is committed to creating long-term, strategic partnerships with our clients who range from Fortune 100 companies to regional manufacturers and distributors. We serve all business sectors of the US economy including (but not limited to) food, retail, government, textiles, and metals/building materials. We strive to offer the best to our clients, transportation partners, and employees– It’s the Mega Way!

For a shipping quote, please CLICK HERE.