November 3, 2020 Freight Market Update

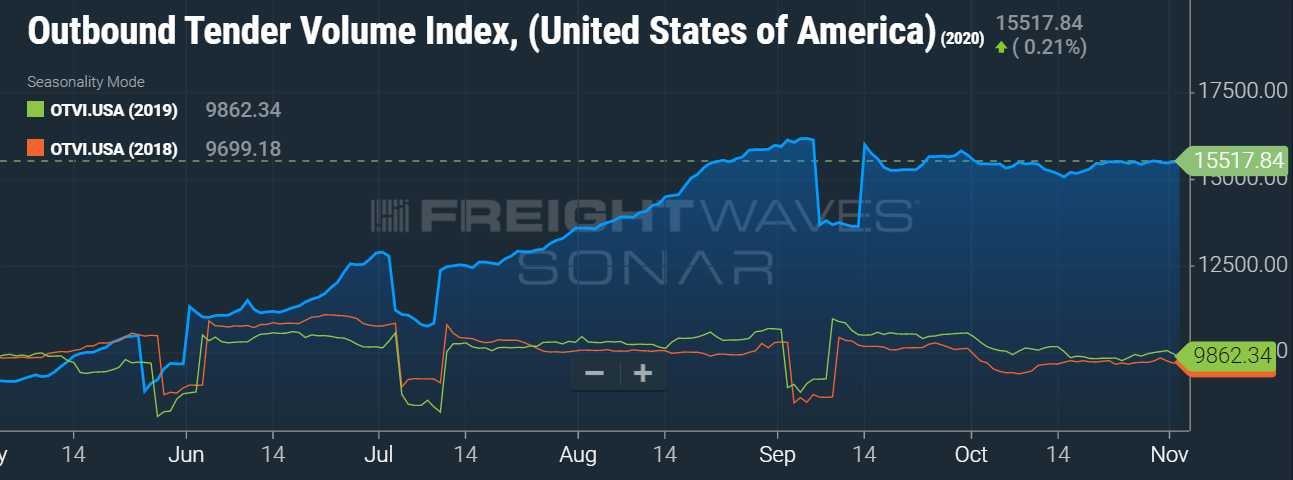

Freight volumes are holding steady at near-record highs, as they have been since mid-August (aside from the temporary decrease after Labor Day). This level will sustain through mid-December. Even the traditional, temporary dip in volume after Thanksgiving will be less noticeable this year as shippers indicate that they are trying to move as much product as possible to maximize consumer holiday spend and a potential second round of panic-buying.

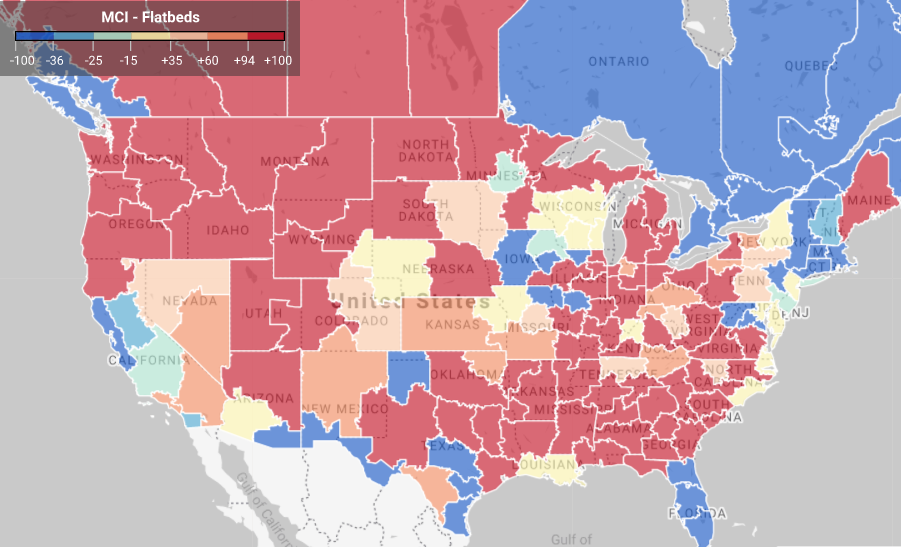

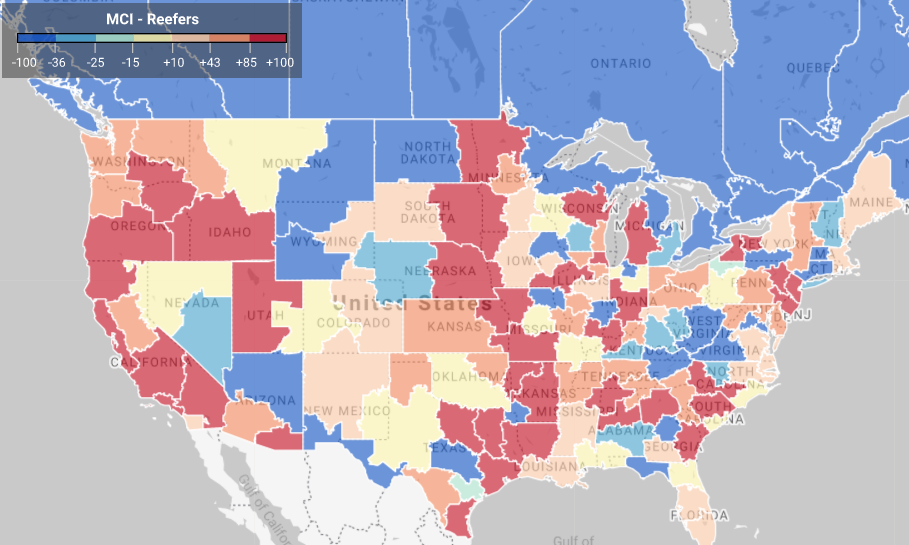

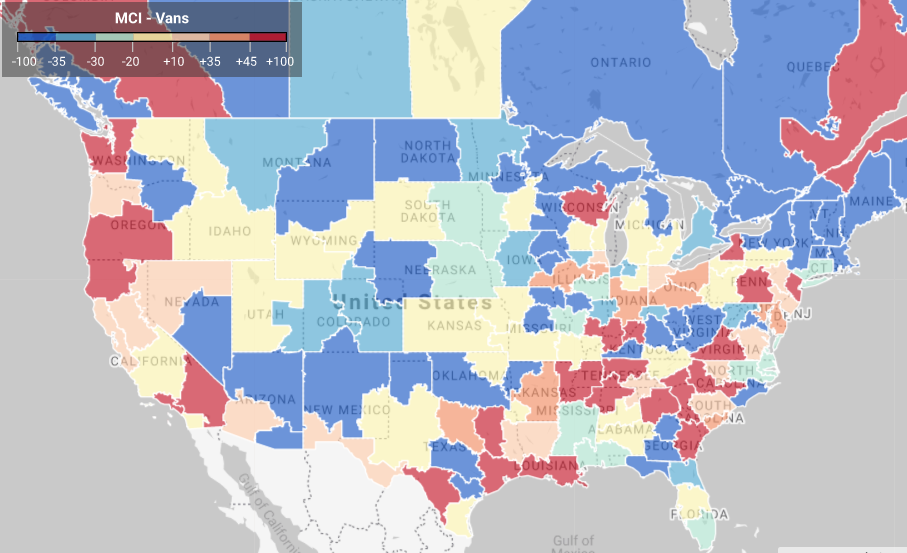

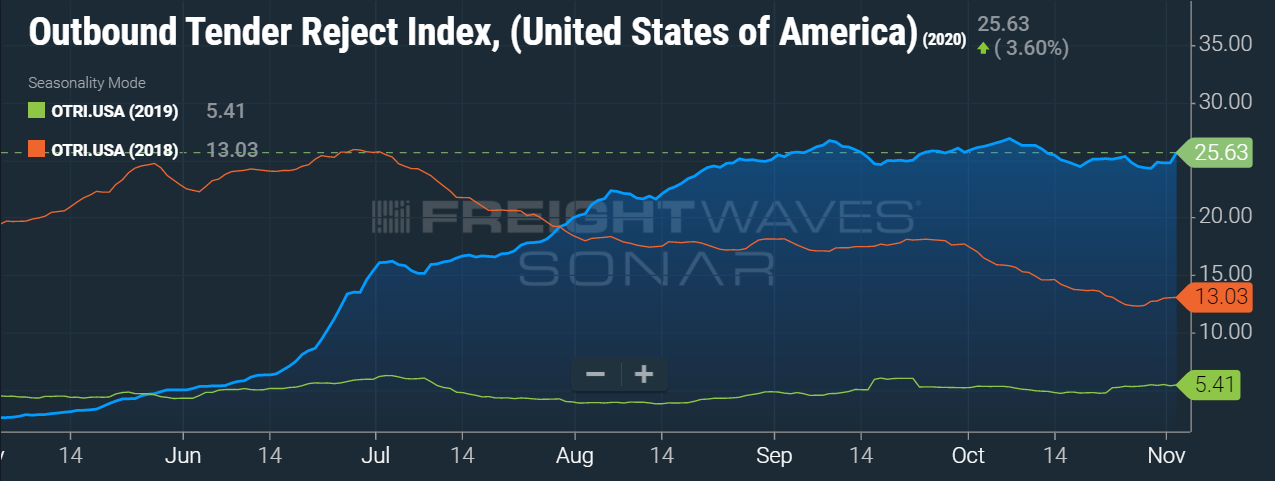

It is no surprise to report another week of tender rejection rates hovering around 25% with not much change in the overall market. Some markets are experiencing this strain more than others since this is the national average. A few smaller markets we monitor for trends have their tender rejections around 45%, while some larger markets are showing a tender rejection rate at 20%. Any way we look at it, capacity is tight and rates are up. However, some markets are seeing temporary loosening as additional overseas shipments make their way through the supply chain. However, this further displaces trucks because these are longer haul shipments that are typically on rail, but due to time and rail capacity restraints, some are opting to move their product via truck load when at this time last year it would have been on rail.

Driver Shortage

This topic has been discussed for years, but it is worth noting again as this number has increased significantly in recent months. A survey was recently taken by the American Transportation Research Institute (ATRI), and the driver shortage topped the critical issue findings because the shortage is made worse by older drivers leaving the business because of the pandemic, along with an alarming 26,000 drivers who failed drug testing mandated by the Federal Motor Carrier Safety Administration Drug and Alcohol Clearinghouse and who have yet to apply for reinstatement.

Training of new drivers curtailed by the pandemic is another issue. Twenty-five percent of driving schools are shut down. Those that are open accommodate half as many students because of social distancing and other COVID-related precautions.

“We’re off 30-40% despite there being more than 12½ million people on unemployment,” Bob Costello, ATA chief economist, said in an on-line chat hosted by the American Trucking Associations’ virtual Management Convention and Exhibition on Tuesday. “That’s more than double where we were a year ago.” Driver pay will have to continually increase to attract new drivers. Costello predicts that we will have a 10%-12% increase in driver pay over the next two quarters and possibly up to 20% in three quarters because the current pay increase is not attracting new drivers.

Even when new drivers are added to the workforce, available equipment has to be purchased depending on the company/fleet and if there is a period of on-the-job training needed, so it could be several months to a year before a difference in capacity is noticed. For example, as part of the carrier vetting process, MegaCorp requires that the company and driver have at least 6 months of consistent working experience, along with references that are verified (and a lengthy list of other checks and verifications) before being one of our dedicated carrier partners. Depending on the commodity, some carrier partners have to have been in business for one year and have at least five trucks.

We will most likely stay in a tighter market longer because of this shortage. Thankfully at MegaCorp we have strong relationships with our reliable, vetted carrier partners so when we commit to picking up a load we are able to see it through no matter what market conditions are from week to week. Exceptional customer service and our clients’ reputations to their customers are very important to us, so we make it a priority to pick up and deliver every load entrusted to MegaCorp.

Load to truck ratio from the prior 7-day average.

About MegaCorp

MegaCorp Logistics, founded by Denise and Ryan Legg in 2009, specializes in full truckload shipments (dry van, refrigerated, flatbed, intermodal, etc.) and less-than-truckload shipments throughout the US, Canada, and Mexico. MegaCorp is committed to creating long-term, strategic partnerships with our clients who range from Fortune 100 companies to regional manufacturers and distributors. We serve all business sectors of the US economy including (but not limited to) food, retail, government, textiles, and metals/building materials. We strive to offer the best to our clients, transportation partners, and employees– It’s the Mega Way!

For a shipping quote, please CLICK HERE.